pacman::p_load(olsrr, corrplot, ggpubr, sf, spdep, GWmodel, tmap, tidyverse, gtsummary)Hands-On Exercise 4

Updated on 10-Dec-2022

(First published on: 9-Dec-2022)

6 Calibrate Hedonic Pricing Model for Private Highrise Property with GWR Method

6.1 Overview

Geographically Weighted Regression (GWR) is a spatial statistical technique that takes non-stationary variables into consideration (e.g., climate; demographic factors; physical environment characteristics) and models the local relationships between these independent variables and an outcome of interest (also known as dependent variable). In this hands-on exercise, we will learn how to build hedonic pricing models by using GWR methods. The dependent variable is the resale prices of condominium in 2015. The independent variables are divided into either structural and locational.

6.2 The Data

Two data sets will be used in this model building exercise, they are:

URA Master Plan subzone boundary in shapefile format (i.e. MP14_SUBZONE_WEB_PL)

condo_resale_2015 in csv format (i.e. condo_resale_2015.csv)

6.3 Getting Started

Before we get started, it is important for us to install the necessary R packages and launch these R packages into R environment.

The R packages needed for this exercise are as follows:

R package for building OLS and performing diagnostics tests - olsrr

R package for calibrating geographical weighted family of models - GWmodel

R package for multivariate data visualisation and analysis - corrplot

Spatial data handling - sf

Attribute data handling - tidyverse, especially readr, ggplot2 and dplyr

Choropleth mapping - tmap

The code chunk below installs and launches these R packages into R environment.

6.4 A brief note on GWmodel

GWmodel package provides a collection of localised spatial statistical methods, namely: GW summary statistics, GW principal components analysis, GW discriminant analysis and various forms of GW regression; some of which are provided in basic and robust (outlier resistant) forms. Commonly, outputs or parameters of the GWmodel are mapped to provide a useful data exploratory tool, which can often precede (and direct) a more traditional or sophisticated statistical analysis.

6.5 Geospatial Data Wrangling

6.5.1 Import geospatial data

The geospatial data used in this hands-on exercise is called MP14_SUBZONE_WEB_PL. It is in ESRI shapefile format. The shapefile consists of URA Master Plan 2014’s planning subzone boundaries. Polygon features are used to represent these geographic boundaries. The GIS data is in svy21 projected coordinates systems.

The code chunk below is used to import MP_SUBZONE_WEB_PL shapefile by using st_read() of sf packages.

mpsz = st_read(dsn = "Hands-On_Ex4/data/geospatial", layer = "MP14_SUBZONE_WEB_PL")Reading layer `MP14_SUBZONE_WEB_PL' from data source

`C:\Cabbie-UK\ISSS624\Hands-On_Ex\Hands-On_Ex4\data\geospatial'

using driver `ESRI Shapefile'

Simple feature collection with 323 features and 15 fields

Geometry type: MULTIPOLYGON

Dimension: XY

Bounding box: xmin: 2667.538 ymin: 15748.72 xmax: 56396.44 ymax: 50256.33

Projected CRS: SVY21The report above shows that the R object used to contain the imported MP14_SUBZONE_WEB_PL shapefile is called mpsz and it is a simple feature object. The geometry type is multipolygon. it is also important to note that mpsz sf object does not have EPSG information.

6.5.2 Update CRS information

The code chunk below updates the newly imported mpsz with the appropriate ESPG code (i.e. 3414)

mpsz_svy21 <- st_transform(mpsz, 3414)After transforming the projection metadata, you can varify the projection of the newly transformed mpsz_svy21 by using st_crs() of sf package.

The code chunk below will be used to varify the newly transformed mpsz_svy21.

st_crs(mpsz_svy21)Coordinate Reference System:

User input: EPSG:3414

wkt:

PROJCRS["SVY21 / Singapore TM",

BASEGEOGCRS["SVY21",

DATUM["SVY21",

ELLIPSOID["WGS 84",6378137,298.257223563,

LENGTHUNIT["metre",1]]],

PRIMEM["Greenwich",0,

ANGLEUNIT["degree",0.0174532925199433]],

ID["EPSG",4757]],

CONVERSION["Singapore Transverse Mercator",

METHOD["Transverse Mercator",

ID["EPSG",9807]],

PARAMETER["Latitude of natural origin",1.36666666666667,

ANGLEUNIT["degree",0.0174532925199433],

ID["EPSG",8801]],

PARAMETER["Longitude of natural origin",103.833333333333,

ANGLEUNIT["degree",0.0174532925199433],

ID["EPSG",8802]],

PARAMETER["Scale factor at natural origin",1,

SCALEUNIT["unity",1],

ID["EPSG",8805]],

PARAMETER["False easting",28001.642,

LENGTHUNIT["metre",1],

ID["EPSG",8806]],

PARAMETER["False northing",38744.572,

LENGTHUNIT["metre",1],

ID["EPSG",8807]]],

CS[Cartesian,2],

AXIS["northing (N)",north,

ORDER[1],

LENGTHUNIT["metre",1]],

AXIS["easting (E)",east,

ORDER[2],

LENGTHUNIT["metre",1]],

USAGE[

SCOPE["Cadastre, engineering survey, topographic mapping."],

AREA["Singapore - onshore and offshore."],

BBOX[1.13,103.59,1.47,104.07]],

ID["EPSG",3414]]Notice that the EPSG: is indicated as 3414 now.

Next, we reveal the extent of mpsz_svy21 by using st_bbox() of sf package. The st_bblox() bounds the sf object in a box

st_bbox(mpsz_svy21) #view extent xmin ymin xmax ymax

2667.538 15748.721 56396.440 50256.334 6.6 Aspatial Data Wrangling

6.6.1 Import the aspatial data

The condo_resale_2015 is in csv file format. The codes chunk below uses read_csv() function of readr package to import condo_resale_2015 into R as a tibble data frame called condo_resale.

condo_resale = read_csv("Hands-On_Ex4/data/aspatial/Condo_resale_2015.csv", show_col_types = FALSE)After importing the data file into R, it is important for us to examine if the data file has been imported correctly.

The codes chunks below uses glimpse() to display the data structure of condo_resale data frame

glimpse(condo_resale)Rows: 1,436

Columns: 23

$ LATITUDE <dbl> 1.287145, 1.328698, 1.313727, 1.308563, 1.321437,…

$ LONGITUDE <dbl> 103.7802, 103.8123, 103.7971, 103.8247, 103.9505,…

$ POSTCODE <dbl> 118635, 288420, 267833, 258380, 467169, 466472, 3…

$ SELLING_PRICE <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1320…

$ AREA_SQM <dbl> 309, 290, 248, 127, 145, 139, 218, 141, 165, 168,…

$ AGE <dbl> 30, 32, 33, 7, 28, 22, 24, 24, 27, 31, 17, 22, 6,…

$ PROX_CBD <dbl> 7.941259, 6.609797, 6.898000, 4.038861, 11.783402…

$ PROX_CHILDCARE <dbl> 0.16597932, 0.28027246, 0.42922669, 0.39473543, 0…

$ PROX_ELDERLYCARE <dbl> 2.5198118, 1.9333338, 0.5021395, 1.9910316, 1.121…

$ PROX_URA_GROWTH_AREA <dbl> 6.618741, 7.505109, 6.463887, 4.906512, 6.410632,…

$ PROX_HAWKER_MARKET <dbl> 1.76542207, 0.54507614, 0.37789301, 1.68259969, 0…

$ PROX_KINDERGARTEN <dbl> 0.05835552, 0.61592412, 0.14120309, 0.38200076, 0…

$ PROX_MRT <dbl> 0.5607188, 0.6584461, 0.3053433, 0.6910183, 0.528…

$ PROX_PARK <dbl> 1.1710446, 0.1992269, 0.2779886, 0.9832843, 0.116…

$ PROX_PRIMARY_SCH <dbl> 1.6340256, 0.9747834, 1.4715016, 1.4546324, 0.709…

$ PROX_TOP_PRIMARY_SCH <dbl> 3.3273195, 0.9747834, 1.4715016, 2.3006394, 0.709…

$ PROX_SHOPPING_MALL <dbl> 2.2102717, 2.9374279, 1.2256850, 0.3525671, 1.307…

$ PROX_SUPERMARKET <dbl> 0.9103958, 0.5900617, 0.4135583, 0.4162219, 0.581…

$ PROX_BUS_STOP <dbl> 0.10336166, 0.28673408, 0.28504777, 0.29872340, 0…

$ NO_Of_UNITS <dbl> 18, 20, 27, 30, 30, 31, 32, 32, 32, 32, 34, 34, 3…

$ FAMILY_FRIENDLY <dbl> 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 0, 0, 0, 0, 0…

$ FREEHOLD <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 1, 1, 1…

$ LEASEHOLD_99YR <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…# see the data in XCOORD column

head(condo_resale$LONGITUDE)[1] 103.7802 103.8123 103.7971 103.8247 103.9505 103.9386#see the data in YCOORD column

head(condo_resale$LATITUDE) [1] 1.287145 1.328698 1.313727 1.308563 1.321437 1.314198We use summary() of base R is used to display the summary statistics of cond_resale tibble data frame.

summary(condo_resale) LATITUDE LONGITUDE POSTCODE SELLING_PRICE

Min. :1.240 Min. :103.7 Min. : 18965 Min. : 540000

1st Qu.:1.309 1st Qu.:103.8 1st Qu.:259849 1st Qu.: 1100000

Median :1.328 Median :103.8 Median :469298 Median : 1383222

Mean :1.334 Mean :103.8 Mean :440439 Mean : 1751211

3rd Qu.:1.357 3rd Qu.:103.9 3rd Qu.:589486 3rd Qu.: 1950000

Max. :1.454 Max. :104.0 Max. :828833 Max. :18000000

AREA_SQM AGE PROX_CBD PROX_CHILDCARE

Min. : 34.0 Min. : 0.00 Min. : 0.3869 Min. :0.004927

1st Qu.:103.0 1st Qu.: 5.00 1st Qu.: 5.5574 1st Qu.:0.174481

Median :121.0 Median :11.00 Median : 9.3567 Median :0.258135

Mean :136.5 Mean :12.14 Mean : 9.3254 Mean :0.326313

3rd Qu.:156.0 3rd Qu.:18.00 3rd Qu.:12.6661 3rd Qu.:0.368293

Max. :619.0 Max. :37.00 Max. :19.1804 Max. :3.465726

PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_HAWKER_MARKET PROX_KINDERGARTEN

Min. :0.05451 Min. :0.2145 Min. :0.05182 Min. :0.004927

1st Qu.:0.61254 1st Qu.:3.1643 1st Qu.:0.55245 1st Qu.:0.276345

Median :0.94179 Median :4.6186 Median :0.90842 Median :0.413385

Mean :1.05351 Mean :4.5981 Mean :1.27987 Mean :0.458903

3rd Qu.:1.35122 3rd Qu.:5.7550 3rd Qu.:1.68578 3rd Qu.:0.578474

Max. :3.94916 Max. :9.1554 Max. :5.37435 Max. :2.229045

PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_TOP_PRIMARY_SCH

Min. :0.05278 Min. :0.02906 Min. :0.07711 Min. :0.07711

1st Qu.:0.34646 1st Qu.:0.26211 1st Qu.:0.44024 1st Qu.:1.34451

Median :0.57430 Median :0.39926 Median :0.63505 Median :1.88213

Mean :0.67316 Mean :0.49802 Mean :0.75471 Mean :2.27347

3rd Qu.:0.84844 3rd Qu.:0.65592 3rd Qu.:0.95104 3rd Qu.:2.90954

Max. :3.48037 Max. :2.16105 Max. :3.92899 Max. :6.74819

PROX_SHOPPING_MALL PROX_SUPERMARKET PROX_BUS_STOP NO_Of_UNITS

Min. :0.0000 Min. :0.0000 Min. :0.001595 Min. : 18.0

1st Qu.:0.5258 1st Qu.:0.3695 1st Qu.:0.098356 1st Qu.: 188.8

Median :0.9357 Median :0.5687 Median :0.151710 Median : 360.0

Mean :1.0455 Mean :0.6141 Mean :0.193974 Mean : 409.2

3rd Qu.:1.3994 3rd Qu.:0.7862 3rd Qu.:0.220466 3rd Qu.: 590.0

Max. :3.4774 Max. :2.2441 Max. :2.476639 Max. :1703.0

FAMILY_FRIENDLY FREEHOLD LEASEHOLD_99YR

Min. :0.0000 Min. :0.0000 Min. :0.0000

1st Qu.:0.0000 1st Qu.:0.0000 1st Qu.:0.0000

Median :0.0000 Median :0.0000 Median :0.0000

Mean :0.4868 Mean :0.4227 Mean :0.4882

3rd Qu.:1.0000 3rd Qu.:1.0000 3rd Qu.:1.0000

Max. :1.0000 Max. :1.0000 Max. :1.0000 6.6.2 Converting aspatial data frame into a sf object

Currently, the condo_resale tibble data frame is aspatial. We will convert it to a sf object. The code chunk below converts condo_resale data frame into a simple feature data frame by using st_as_sf() of sf packages.

condo_resale.sf <- st_as_sf(condo_resale,

coords = c("LONGITUDE", "LATITUDE"),

crs=4326) %>%

st_transform(crs=3414)Notice that st_transform() of sf package is used to convert the coordinates from wgs84 (i.e. crs:4326) to svy21 (i.e. crs=3414).

Next, head() is used to list the content of condo_resale.sf object.

head(condo_resale.sf)Simple feature collection with 6 features and 21 fields

Geometry type: POINT

Dimension: XY

Bounding box: xmin: 22085.12 ymin: 29951.54 xmax: 41042.56 ymax: 34546.2

Projected CRS: SVY21 / Singapore TM

# A tibble: 6 × 22

POSTCODE SELLI…¹ AREA_…² AGE PROX_…³ PROX_…⁴ PROX_…⁵ PROX_…⁶ PROX_…⁷ PROX_…⁸

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 118635 3000000 309 30 7.94 0.166 2.52 6.62 1.77 0.0584

2 288420 3880000 290 32 6.61 0.280 1.93 7.51 0.545 0.616

3 267833 3325000 248 33 6.90 0.429 0.502 6.46 0.378 0.141

4 258380 4250000 127 7 4.04 0.395 1.99 4.91 1.68 0.382

5 467169 1400000 145 28 11.8 0.119 1.12 6.41 0.565 0.461

6 466472 1320000 139 22 10.3 0.125 0.789 5.09 0.781 0.0994

# … with 12 more variables: PROX_MRT <dbl>, PROX_PARK <dbl>,

# PROX_PRIMARY_SCH <dbl>, PROX_TOP_PRIMARY_SCH <dbl>,

# PROX_SHOPPING_MALL <dbl>, PROX_SUPERMARKET <dbl>, PROX_BUS_STOP <dbl>,

# NO_Of_UNITS <dbl>, FAMILY_FRIENDLY <dbl>, FREEHOLD <dbl>,

# LEASEHOLD_99YR <dbl>, geometry <POINT [m]>, and abbreviated variable names

# ¹SELLING_PRICE, ²AREA_SQM, ³PROX_CBD, ⁴PROX_CHILDCARE, ⁵PROX_ELDERLYCARE,

# ⁶PROX_URA_GROWTH_AREA, ⁷PROX_HAWKER_MARKET, ⁸PROX_KINDERGARTENNotice that the output (Geometry Type) is in point feature data frame.

6.7 Exploratory Data Analysis (EDA)

In the section, we learn how to use statistical graphics functions of ggplot2 package to perform EDA.

6.7.1 EDA using statistical graphics

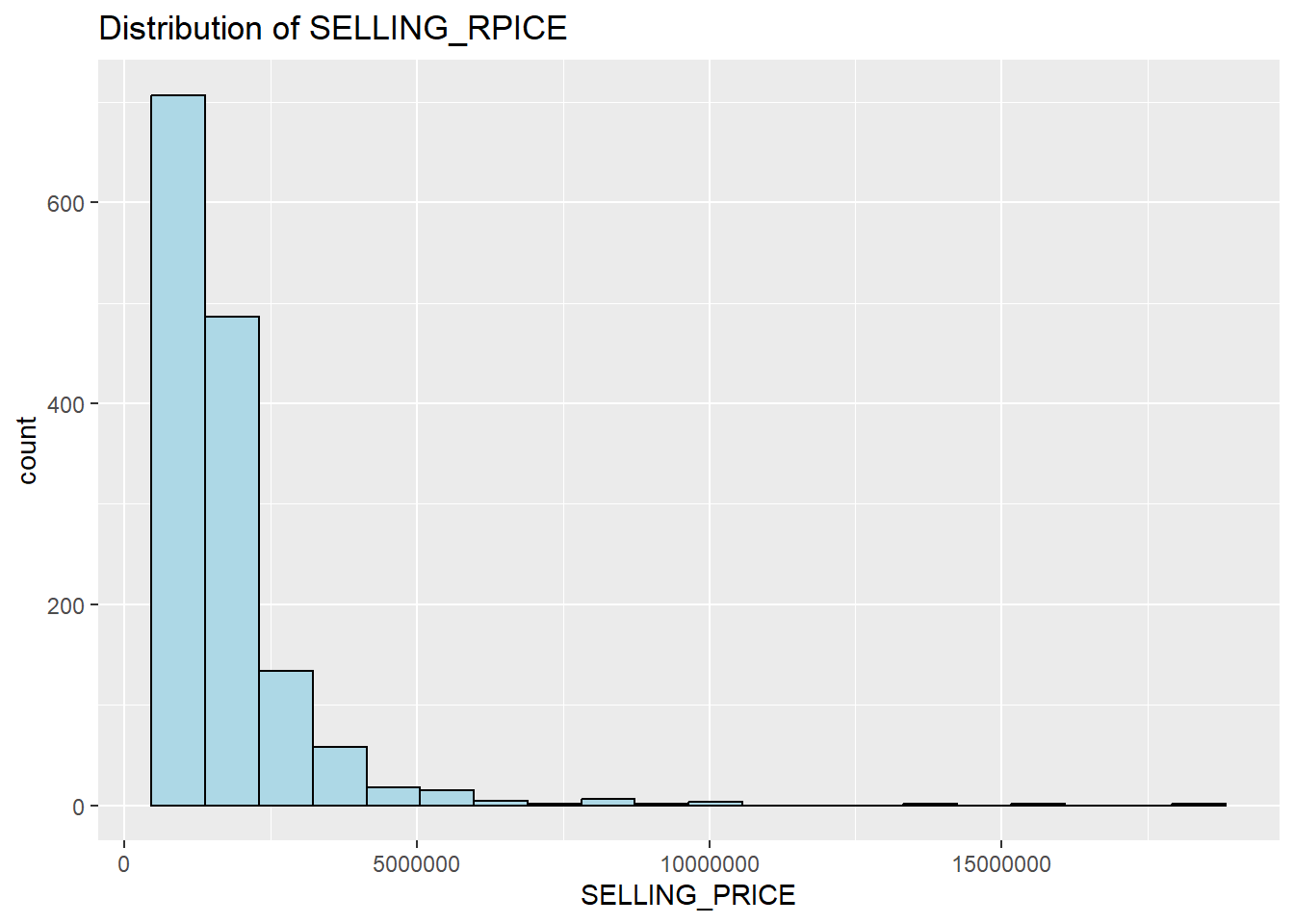

We plot the distribution of SELLING_PRICE as shown in the code chunk below.

options(scipen=999)

ggplot(data=condo_resale.sf, aes(x=`SELLING_PRICE`)) +

geom_histogram(bins=20, color="black", fill="light blue") +

ggtitle("Distribution of SELLING_RPICE")

The chart above reveals a right-skewed distribution. This means that more condominium units were transacted at relatively lower prices.

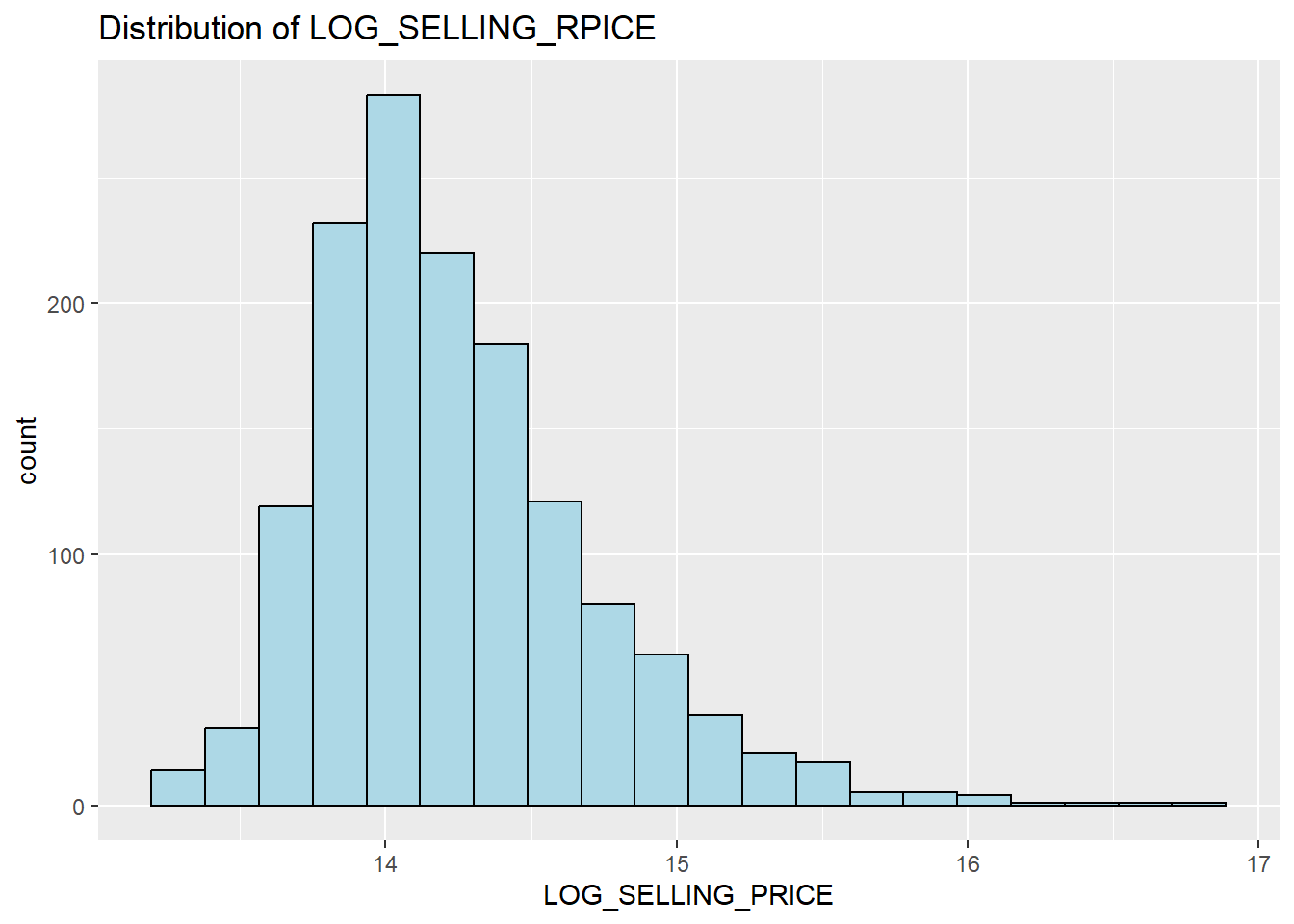

Statistically, the right-skewed distribution can be normalised by using log transformation. The code chunk below is used to derive a new variable called LOG_SELLING_PRICE by using a log transformation on the variable SELLING_PRICE. It is performed using mutate() of dplyr package.

# We add a constant +1 to avoid a situation where selling price = 0

condo_resale.sf <- condo_resale.sf %>%

mutate(`LOG_SELLING_PRICE` = log(SELLING_PRICE+1))Now, you can plot the LOG_SELLING_PRICE using the code chunk below.

ggplot(data=condo_resale.sf, aes(x=`LOG_SELLING_PRICE`)) +

geom_histogram(bins=20, color="black", fill="light blue") +

ggtitle("Distribution of LOG_SELLING_RPICE")

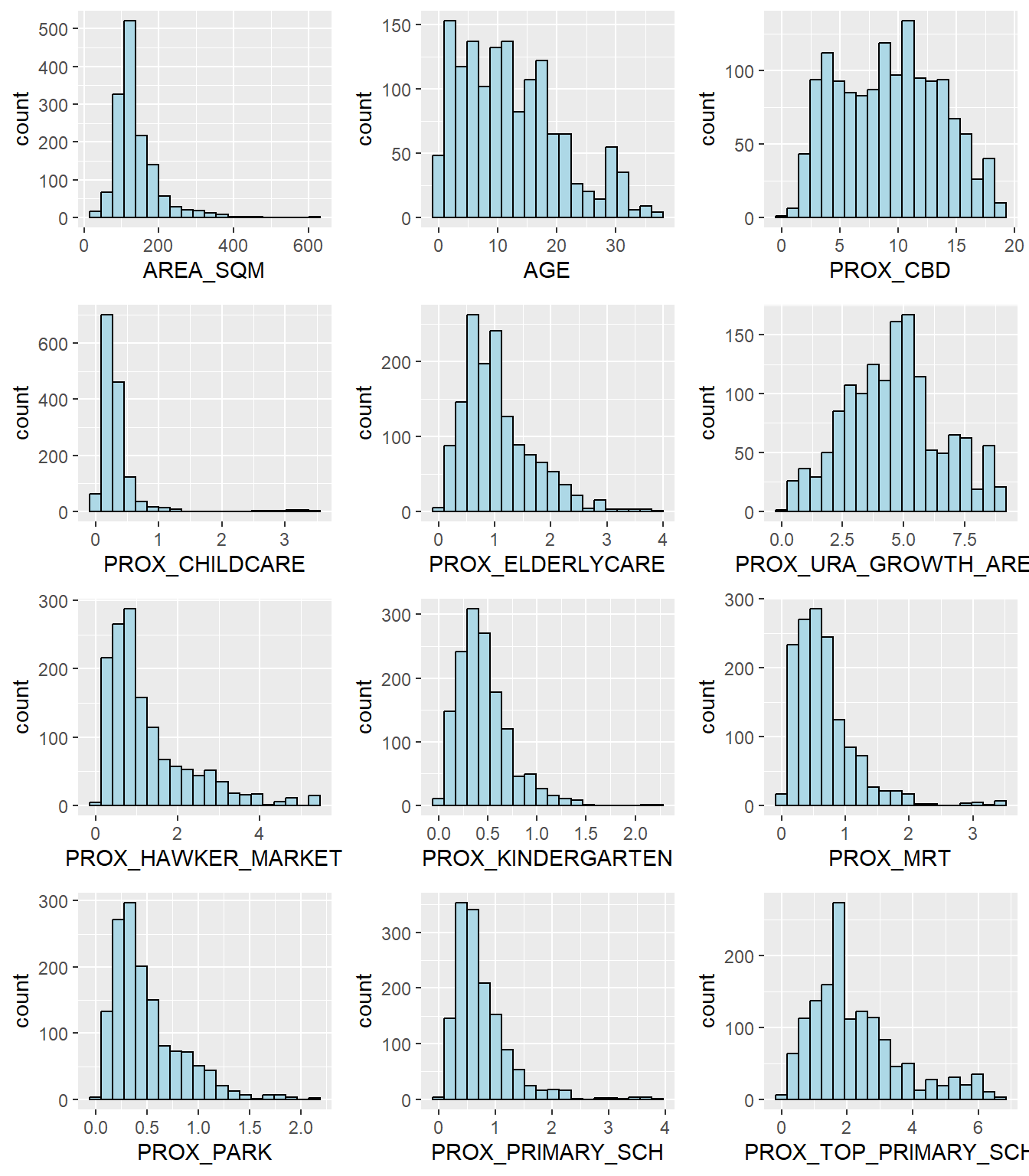

6.7.2 Multiple Histogram Plots distribution of variables

In this section,we learn how to draw a small multiple histograms (also known as Trellis plot) by using ggarrange() of ggpubr package.

The code chunk below is used to create 12 histograms. Then, ggarrange() is used to organised these histogram into a 3 columns by 4 rows small multiple plot.

AREA_SQM <- ggplot(data=condo_resale.sf, aes(x= `AREA_SQM`)) +

geom_histogram(bins=20, color="black", fill="light blue")

AGE <- ggplot(data=condo_resale.sf, aes(x= `AGE`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_CBD <- ggplot(data=condo_resale.sf, aes(x= `PROX_CBD`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_CHILDCARE <- ggplot(data=condo_resale.sf, aes(x= `PROX_CHILDCARE`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_ELDERLYCARE <- ggplot(data=condo_resale.sf, aes(x= `PROX_ELDERLYCARE`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_URA_GROWTH_AREA <- ggplot(data=condo_resale.sf,

aes(x= `PROX_URA_GROWTH_AREA`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_HAWKER_MARKET <- ggplot(data=condo_resale.sf, aes(x= `PROX_HAWKER_MARKET`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_KINDERGARTEN <- ggplot(data=condo_resale.sf, aes(x= `PROX_KINDERGARTEN`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_MRT <- ggplot(data=condo_resale.sf, aes(x= `PROX_MRT`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_PARK <- ggplot(data=condo_resale.sf, aes(x= `PROX_PARK`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_PRIMARY_SCH <- ggplot(data=condo_resale.sf, aes(x= `PROX_PRIMARY_SCH`)) +

geom_histogram(bins=20, color="black", fill="light blue")

PROX_TOP_PRIMARY_SCH <- ggplot(data=condo_resale.sf,

aes(x= `PROX_TOP_PRIMARY_SCH`)) +

geom_histogram(bins=20, color="black", fill="light blue")

ggarrange(AREA_SQM, AGE, PROX_CBD, PROX_CHILDCARE, PROX_ELDERLYCARE,

PROX_URA_GROWTH_AREA, PROX_HAWKER_MARKET, PROX_KINDERGARTEN, PROX_MRT,

PROX_PARK, PROX_PRIMARY_SCH, PROX_TOP_PRIMARY_SCH,

ncol = 3, nrow = 4)

6.7.3 Drawing Statistical Point Map

Lastly, we want to review the geospatial distribution condominium resale prices in Singapore. The map will be prepared by using tmap package.

First, we will turn on the interactive mode of tmap by using the code chunk below.

tmap_mode("view")Next, the code chunks below is used to create an interactive point symbol map.

tmap_options(check.and.fix = TRUE)

tm_shape(mpsz_svy21)+

tm_polygons() +

tm_shape(condo_resale.sf) +

tm_dots(col = "SELLING_PRICE",

alpha = 0.6,

style="quantile") +

tm_view(set.zoom.limits = c(11,14))Notice that tm_dots() is used instead of tm_bubbles().

set.zoom.limits argument of tm_view() sets the minimum and maximum zoom level to 11 and 14 respectively.

Before moving on to the next section, the code below will be used to turn R display into plot mode.

tmap_mode("plot")6.8 Hedonic Pricing Modelling in R

In this section, we learn how to building hedonic pricing models for condominium resale units using lm() of R base.

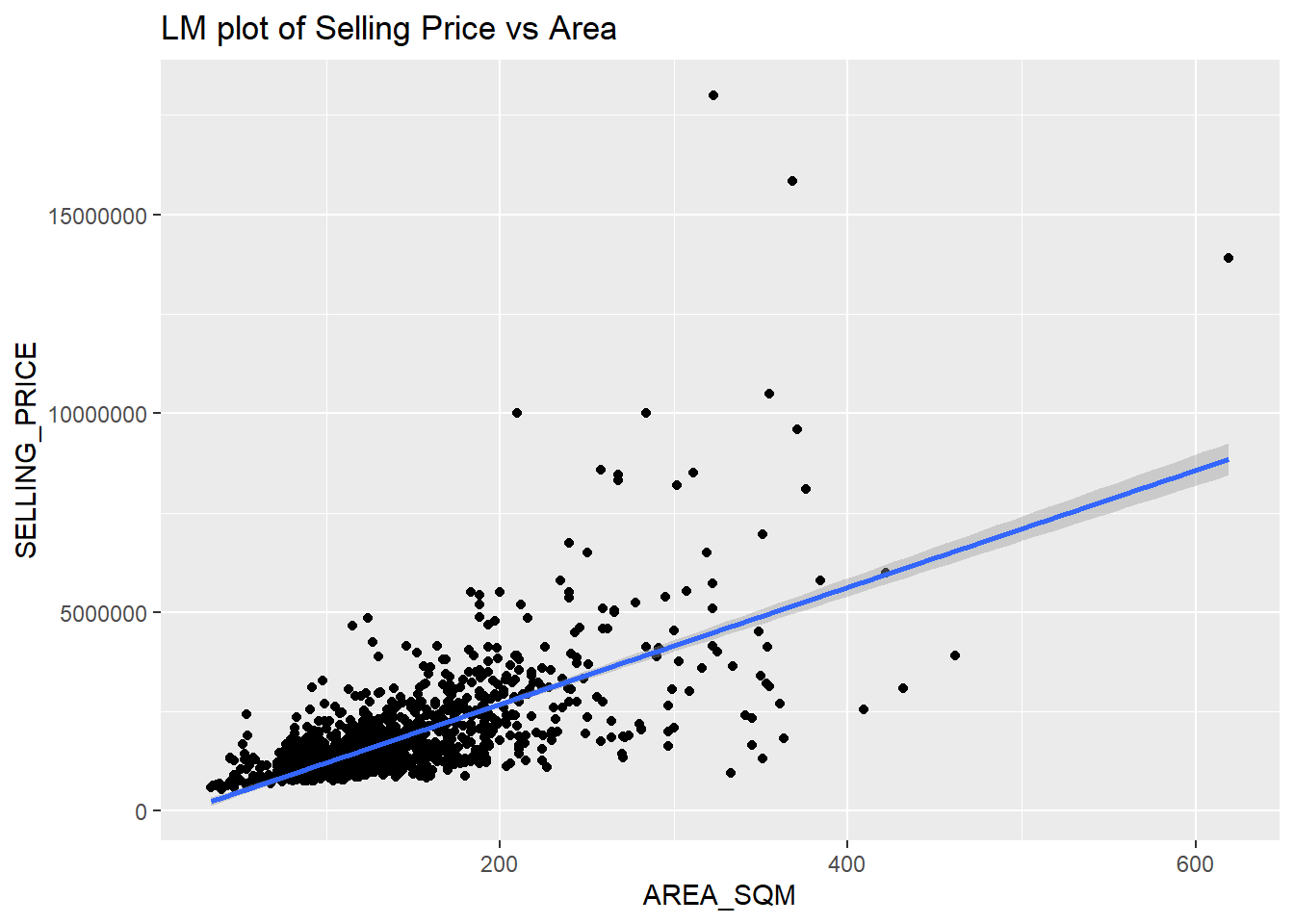

6.8.1 Simple Linear Regression Method

First, we will build a simple linear regression model by using SELLING_PRICE as the dependent variable and AREA_SQM as the independent variable.

condo.slr <- lm(formula=SELLING_PRICE ~ AREA_SQM, data = condo_resale.sf)lm() returns an object of class “lm” or for multiple responses of class c(“mlm”, “lm”).

The functions summary() and anova() can be used to obtain and print a summary and analysis of variance table of the results.

summary(condo.slr)

Call:

lm(formula = SELLING_PRICE ~ AREA_SQM, data = condo_resale.sf)

Residuals:

Min 1Q Median 3Q Max

-3695815 -391764 -87517 258900 13503875

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -258121.1 63517.2 -4.064 0.0000509 ***

AREA_SQM 14719.0 428.1 34.381 < 0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 942700 on 1434 degrees of freedom

Multiple R-squared: 0.4518, Adjusted R-squared: 0.4515

F-statistic: 1182 on 1 and 1434 DF, p-value: < 0.00000000000000022anova(condo.slr)Analysis of Variance Table

Response: SELLING_PRICE

Df Sum Sq Mean Sq F value Pr(>F)

AREA_SQM 1 1050376876745474 1050376876745474 1182 < 0.00000000000000022

Residuals 1434 1274269843399565 888612164156

AREA_SQM ***

Residuals

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1The output report reveals that the SELLING_PRICE can be explained by using the formula:

*y = -258121.1 + 14719x1* where x1 is the AREA_SQMThe R-squared (aka Coefficient of Determination) of 0.4518 reveals that the simple regression model built is able to explain about 45% of the variation in resale prices.

Y = 𝛼 + 𝛽X

ANOVA of mean:

The Analysis of Variance report provides the calculations for comparing the fitted model to a simple mean model. The hypotheses for the F-test are:

H0: 𝛽1 = 𝛽2 =. . . . = 𝛽𝑘 = 0

H1: N𝑜𝑡 𝑎𝑙𝑙 𝑒𝑞𝑢𝑎𝑙 𝑡𝑜 0

where k is the number of independent variables.

It reveals that the F-ratio is 1182 which is significant at p < 0.0001. This result tells us that there are less than 0.01% chance that an F-ratio this large will happen if the null hypothesis is true. Therefore, we can conclude that our regression model result is significantly better explanatory model of SELLING PRICE than if we used the mean value of re-sale prices. In short, the regression model overall estimates SELLING PRICE significantly well.

For the intercept and slope values under the Coefficients section

H0: α = 0 (intercept)

H1: α ≠ 0

H0: β = 0 (slope)

H1: β ≠ 0

The report reveals that the p-values of both the estimates of the Intercept and ARA_SQM are smaller than 0.001. In view of this, the null hypothesis of the α and β are equal to 0 will be rejected. As a result, we infer that the α and β are good parameter estimates.

To visualise the best fit curve on a scatterplot, we can incorporate lm() as a method function in ggplot as shown in the code chunk below.

ggplot(data=condo_resale.sf,

aes(x=`AREA_SQM`, y=`SELLING_PRICE`)) +

geom_point() +

geom_smooth(method = lm) +

ggtitle("LM plot of Selling Price vs Area")

The chart above reveals that there are a few outliers with relatively high selling prices.

6.8.2 Multiple Linear Regression Method

6.8.2.1 Visualising the relationships of the independent variables

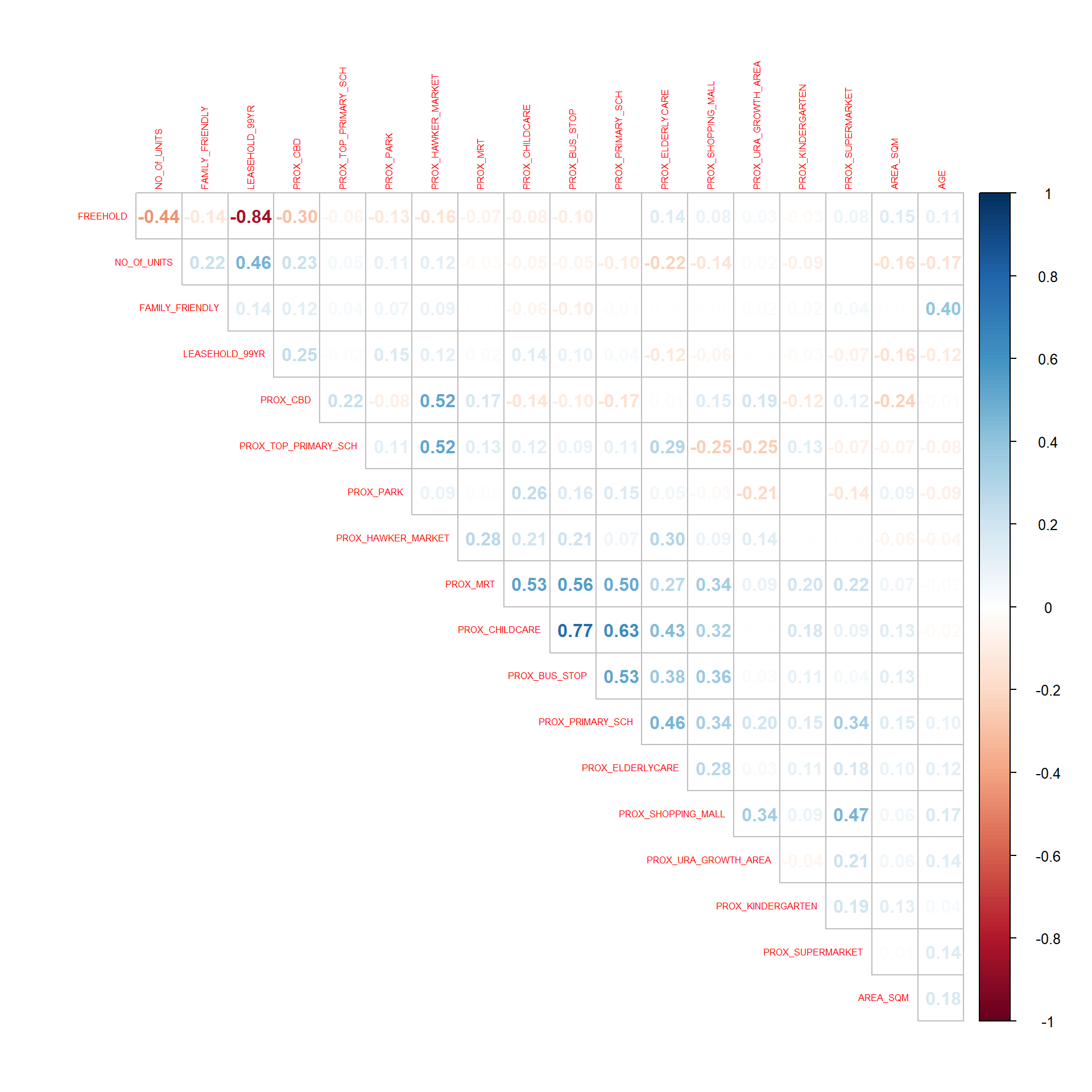

Before building a multiple regression model, it is important to ensure that the independent variables used are not highly correlated to each other. If these highly correlated independent variables are used in building a regression model by mistake, the quality of the model will be compromised. This phenomenon is known as multicollinearity in statistics.

Correlation matrix is commonly used to visualise the relationships between the independent variables. Beside the pairs() of R, many packages support the display of a correlation matrix. In this section, the corrplot package is used.

The code chunk below is used to plot a matrix of the relationship between the independent variables in condo_resale data.frame.

corrplot(cor(condo_resale[, 5:23]), diag = FALSE, order = "AOE",

tl.pos = "td", tl.cex = 0.5, method = "number", type = "upper")

Things to note:

The matrix order argument is very important for determining the hidden structure and pattern in the matrix. There are four methods in corrplot (parameter order), named “AOE”, “FPC”, “hclust”, “alphabet”. In the code chunk above, AOE order is used. It orders the variables by using the angular order of the eigenvectors method suggested by Michael Friendly.

From the plotted matrix, it is clear that Freehold is highly correlated to LEASE_99YEAR. In view of this, it is wiser to only include either one of them in the subsequent model building. As a result, LEASE_99YEAR is excluded in the subsequent model building.

6.8.3 Build a hedonic pricing model using multiple linear regression method

The code chunk below using lm() to calibrate the multiple linear regression model.

# Fit the regrssion model

condo.mlr <- lm(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_HAWKER_MARKET + PROX_KINDERGARTEN +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_TOP_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_SUPERMARKET +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sf)

# Display the results

summary(condo.mlr)

Call:

lm(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD + PROX_CHILDCARE +

PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA + PROX_HAWKER_MARKET +

PROX_KINDERGARTEN + PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_TOP_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_SUPERMARKET +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sf)

Residuals:

Min 1Q Median 3Q Max

-3475964 -293923 -23069 241043 12260381

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 481728.40 121441.01 3.967 0.000076494714281 ***

AREA_SQM 12708.32 369.59 34.385 < 0.0000000000000002 ***

AGE -24440.82 2763.16 -8.845 < 0.0000000000000002 ***

PROX_CBD -78669.78 6768.97 -11.622 < 0.0000000000000002 ***

PROX_CHILDCARE -351617.91 109467.25 -3.212 0.00135 **

PROX_ELDERLYCARE 171029.42 42110.51 4.061 0.000051440615323 ***

PROX_URA_GROWTH_AREA 38474.53 12523.57 3.072 0.00217 **

PROX_HAWKER_MARKET 23746.10 29299.76 0.810 0.41782

PROX_KINDERGARTEN 147468.99 82668.87 1.784 0.07466 .

PROX_MRT -314599.68 57947.44 -5.429 0.000000066573105 ***

PROX_PARK 563280.50 66551.68 8.464 < 0.0000000000000002 ***

PROX_PRIMARY_SCH 180186.08 65237.95 2.762 0.00582 **

PROX_TOP_PRIMARY_SCH 2280.04 20410.43 0.112 0.91107

PROX_SHOPPING_MALL -206604.06 42840.60 -4.823 0.000001569612974 ***

PROX_SUPERMARKET -44991.80 77082.64 -0.584 0.55953

PROX_BUS_STOP 683121.35 138353.28 4.938 0.000000885077155 ***

NO_Of_UNITS -231.18 89.03 -2.597 0.00951 **

FAMILY_FRIENDLY 140340.77 47020.55 2.985 0.00289 **

FREEHOLD 359913.01 49220.22 7.312 0.000000000000438 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 755800 on 1417 degrees of freedom

Multiple R-squared: 0.6518, Adjusted R-squared: 0.6474

F-statistic: 147.4 on 18 and 1417 DF, p-value: < 0.000000000000000226.8.4 Prepare Publication Quality Table: olsrr method

With reference to the report above, it is clear that not all the independent variables are statistically significant. We will revise the model by removing those variables which are not statistically significant.

Now, we are ready to calibrate a revised model by using the code chunk below.

condo.mlr1 <- lm(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sf)

ols_regress(condo.mlr1) Model Summary

------------------------------------------------------------------------

R 0.807 RMSE 755957.289

R-Squared 0.651 Coef. Var 43.168

Adj. R-Squared 0.647 MSE 571471422208.591

Pred R-Squared 0.638 MAE 414819.628

------------------------------------------------------------------------

RMSE: Root Mean Square Error

MSE: Mean Square Error

MAE: Mean Absolute Error

ANOVA

-------------------------------------------------------------------------------------------

Sum of

Squares DF Mean Square F Sig.

-------------------------------------------------------------------------------------------

Regression 1512585829186630.500 14 108041844941902.172 189.059 0.0000

Residual 812060890958408.500 1421 571471422208.591

Total 2324646720145039.000 1435

-------------------------------------------------------------------------------------------

Parameter Estimates

-----------------------------------------------------------------------------------------------------------------

model Beta Std. Error Std. Beta t Sig lower upper

-----------------------------------------------------------------------------------------------------------------

(Intercept) 527633.222 108183.223 4.877 0.000 315417.244 739849.200

AREA_SQM 12777.523 367.479 0.584 34.771 0.000 12056.663 13498.382

AGE -24687.739 2754.845 -0.167 -8.962 0.000 -30091.739 -19283.740

PROX_CBD -77131.323 5763.125 -0.263 -13.384 0.000 -88436.469 -65826.176

PROX_CHILDCARE -318472.751 107959.512 -0.084 -2.950 0.003 -530249.889 -106695.613

PROX_ELDERLYCARE 185575.623 39901.864 0.090 4.651 0.000 107302.737 263848.510

PROX_URA_GROWTH_AREA 39163.254 11754.829 0.060 3.332 0.001 16104.571 62221.936

PROX_MRT -294745.107 56916.367 -0.112 -5.179 0.000 -406394.234 -183095.980

PROX_PARK 570504.807 65507.029 0.150 8.709 0.000 442003.938 699005.677

PROX_PRIMARY_SCH 159856.136 60234.599 0.062 2.654 0.008 41697.849 278014.424

PROX_SHOPPING_MALL -220947.251 36561.832 -0.115 -6.043 0.000 -292668.213 -149226.288

PROX_BUS_STOP 682482.221 134513.243 0.134 5.074 0.000 418616.359 946348.082

NO_Of_UNITS -245.480 87.947 -0.053 -2.791 0.005 -418.000 -72.961

FAMILY_FRIENDLY 146307.576 46893.021 0.057 3.120 0.002 54320.593 238294.560

FREEHOLD 350599.812 48506.485 0.136 7.228 0.000 255447.802 445751.821

-----------------------------------------------------------------------------------------------------------------6.8.5 Prepare Publication Quality Table: gtsummary method

The gtsummary package provides an elegant and flexible way to create publication-ready summary tables in R.

In the code chunk below, tbl_regression() is used to create a well formatted regression report.

tbl_regression(condo.mlr1, intercept = TRUE)| Characteristic | Beta | 95% CI1 | p-value |

|---|---|---|---|

| (Intercept) | 527,633 | 315,417, 739,849 | <0.001 |

| AREA_SQM | 12,778 | 12,057, 13,498 | <0.001 |

| AGE | -24,688 | -30,092, -19,284 | <0.001 |

| PROX_CBD | -77,131 | -88,436, -65,826 | <0.001 |

| PROX_CHILDCARE | -318,473 | -530,250, -106,696 | 0.003 |

| PROX_ELDERLYCARE | 185,576 | 107,303, 263,849 | <0.001 |

| PROX_URA_GROWTH_AREA | 39,163 | 16,105, 62,222 | <0.001 |

| PROX_MRT | -294,745 | -406,394, -183,096 | <0.001 |

| PROX_PARK | 570,505 | 442,004, 699,006 | <0.001 |

| PROX_PRIMARY_SCH | 159,856 | 41,698, 278,014 | 0.008 |

| PROX_SHOPPING_MALL | -220,947 | -292,668, -149,226 | <0.001 |

| PROX_BUS_STOP | 682,482 | 418,616, 946,348 | <0.001 |

| NO_Of_UNITS | -245 | -418, -73 | 0.005 |

| FAMILY_FRIENDLY | 146,308 | 54,321, 238,295 | 0.002 |

| FREEHOLD | 350,600 | 255,448, 445,752 | <0.001 |

| 1 CI = Confidence Interval | |||

With the gtsummary package, model statistics can be included in the report by either appending them to the report table by using add_glance_table() or adding as a table source note by using add_glance_source_note() as shown in the code chunk below.

tbl_regression(condo.mlr1,

intercept = TRUE) %>%

add_glance_source_note(

label = list(sigma ~ "\U03C3"),

include = c(r.squared, adj.r.squared,

AIC, statistic,

p.value, sigma))| Characteristic | Beta | 95% CI1 | p-value |

|---|---|---|---|

| (Intercept) | 527,633 | 315,417, 739,849 | <0.001 |

| AREA_SQM | 12,778 | 12,057, 13,498 | <0.001 |

| AGE | -24,688 | -30,092, -19,284 | <0.001 |

| PROX_CBD | -77,131 | -88,436, -65,826 | <0.001 |

| PROX_CHILDCARE | -318,473 | -530,250, -106,696 | 0.003 |

| PROX_ELDERLYCARE | 185,576 | 107,303, 263,849 | <0.001 |

| PROX_URA_GROWTH_AREA | 39,163 | 16,105, 62,222 | <0.001 |

| PROX_MRT | -294,745 | -406,394, -183,096 | <0.001 |

| PROX_PARK | 570,505 | 442,004, 699,006 | <0.001 |

| PROX_PRIMARY_SCH | 159,856 | 41,698, 278,014 | 0.008 |

| PROX_SHOPPING_MALL | -220,947 | -292,668, -149,226 | <0.001 |

| PROX_BUS_STOP | 682,482 | 418,616, 946,348 | <0.001 |

| NO_Of_UNITS | -245 | -418, -73 | 0.005 |

| FAMILY_FRIENDLY | 146,308 | 54,321, 238,295 | 0.002 |

| FREEHOLD | 350,600 | 255,448, 445,752 | <0.001 |

| R² = 0.651; Adjusted R² = 0.647; AIC = 42,967; Statistic = 189; p-value = <0.001; σ = 755,957 | |||

| 1 CI = Confidence Interval | |||

The additional statistics have been added at the bottom of the report.

For more customisation options, refer to Tutorial: tbl_regression

6.8.5.1 Checking for multicolinearity

In this section, we would use a fantastic R package specially programmed for performing OLS regression. It is called olsrr. It provides a collection of very useful methods for building better multiple linear regression models:

comprehensive regression output

residual diagnostics

measures of influence

heteroskedasticity tests

collinearity diagnostics

model fit assessment

variable contribution assessment

variable selection procedures

In the code chunk below, the ols_vif_tol() of olsrr package is used to test if there are sign of multicollinearity.

ols_vif_tol(condo.mlr1) Variables Tolerance VIF

1 AREA_SQM 0.8728554 1.145665

2 AGE 0.7071275 1.414172

3 PROX_CBD 0.6356147 1.573280

4 PROX_CHILDCARE 0.3066019 3.261559

5 PROX_ELDERLYCARE 0.6598479 1.515501

6 PROX_URA_GROWTH_AREA 0.7510311 1.331503

7 PROX_MRT 0.5236090 1.909822

8 PROX_PARK 0.8279261 1.207837

9 PROX_PRIMARY_SCH 0.4524628 2.210126

10 PROX_SHOPPING_MALL 0.6738795 1.483945

11 PROX_BUS_STOP 0.3514118 2.845664

12 NO_Of_UNITS 0.6901036 1.449058

13 FAMILY_FRIENDLY 0.7244157 1.380423

14 FREEHOLD 0.6931163 1.442759Since the VIF of the independent variables is less than 10. We can safely conclude that there are no sign of multicollinearity among the independent variables.

6.8.5.2 Test for Non-Linearity

In multiple linear regression, it is important for us to test the assumption that linearity and additivity of the relationship between dependent and independent variables.

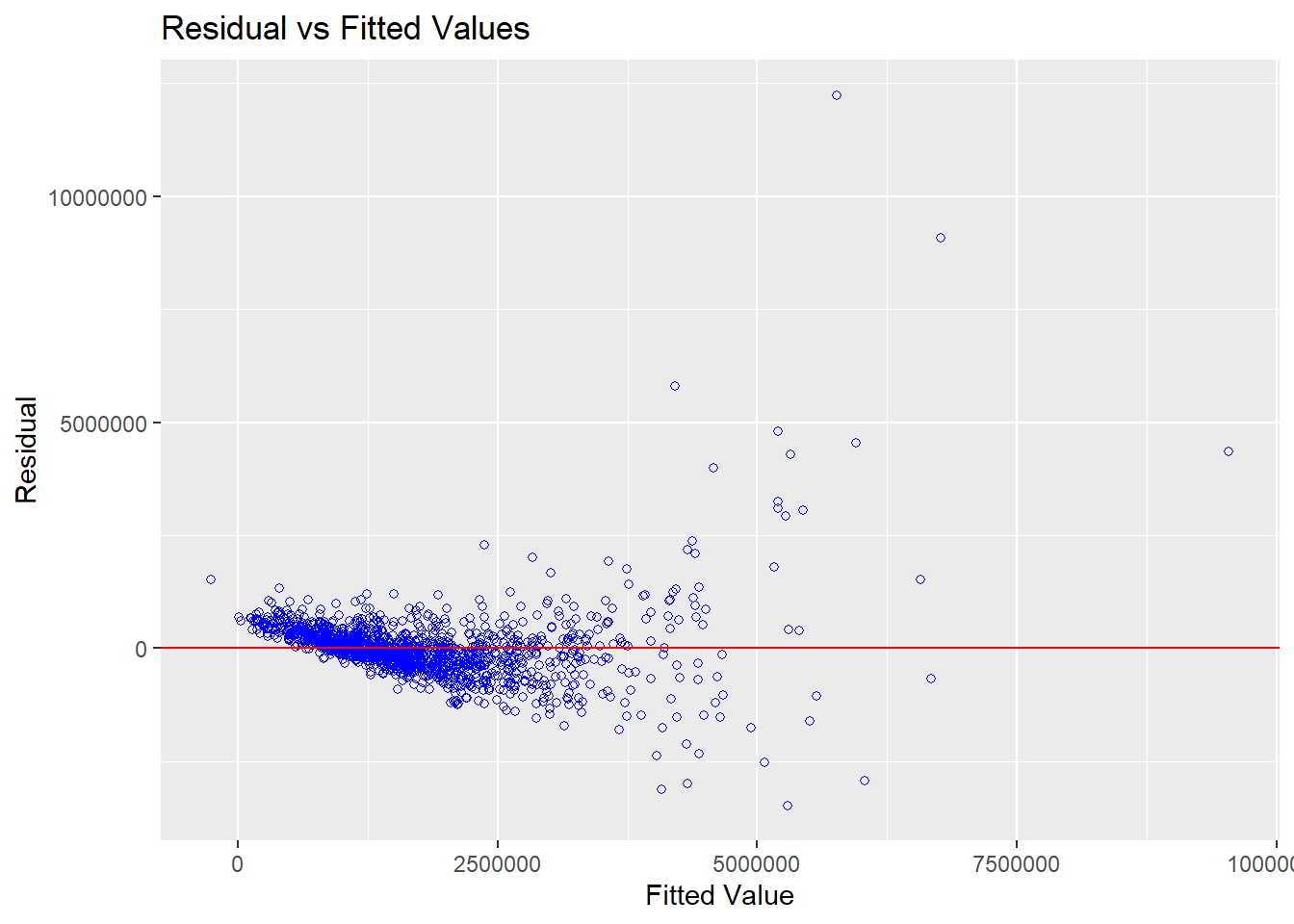

In the code chunk below, the ols_plot_resid_fit() of olsrr package is used to perform linearity assumption test.

ols_plot_resid_fit(condo.mlr1)

The chart above reveals that most of the data poitns are scattered around the 0 line. Hence we can safely conclude that the relationships between the dependent variable and independent variables are linear.

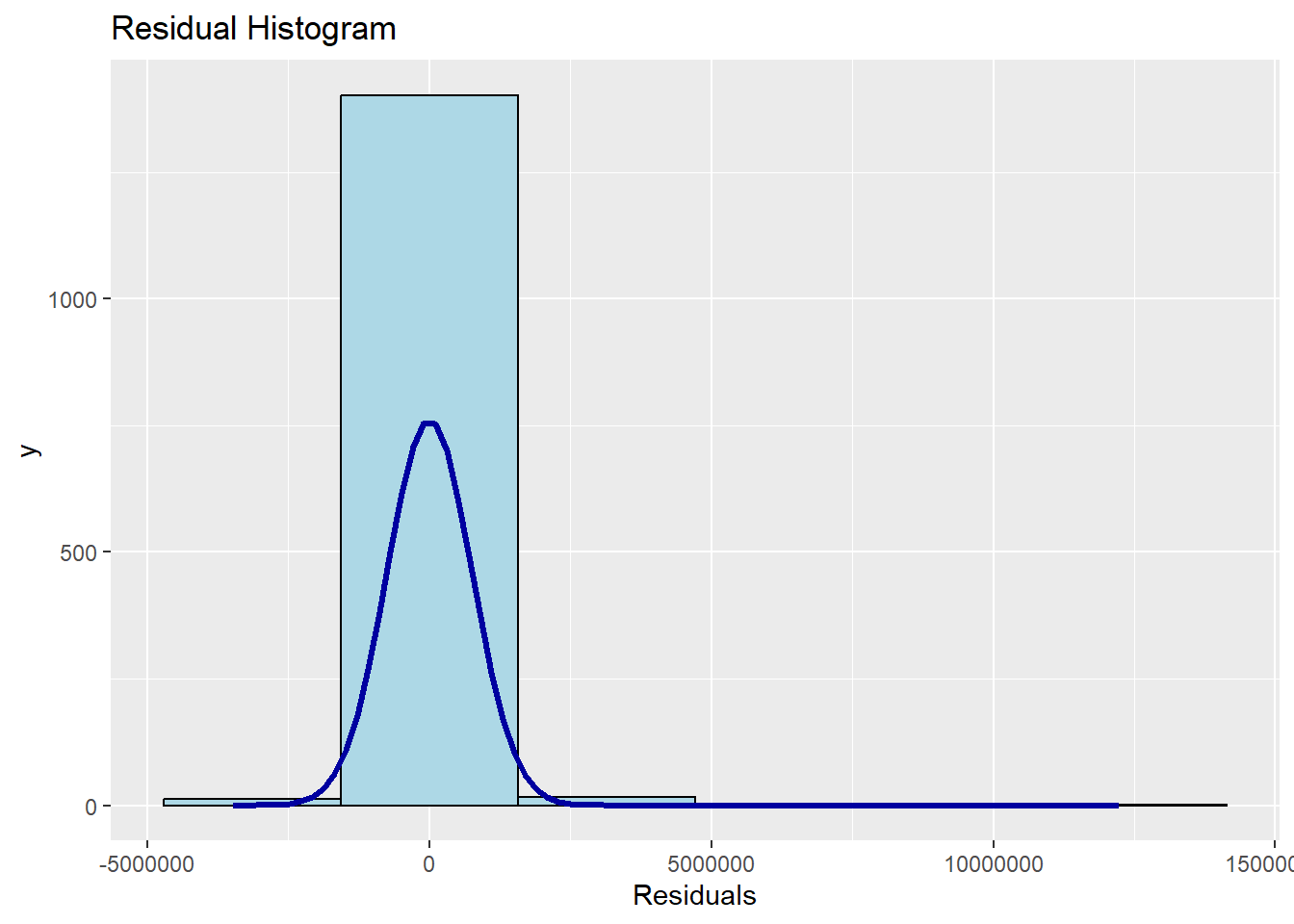

6.8.5.3 Test for Normality Assumption of the residual errors

Lastly, the code chunk below uses ols_plot_resid_hist() of olsrr package to perform normality assumption test.

ols_plot_resid_hist(condo.mlr1)

The figure reveals that the residual of the multiple linear regression model (i.e. condo.mlr1) resembles normal distribution.

For formal statistical test methods, the ols_test_normality() of olsrr package can be used as shown in the code chun below.

ols_test_normality(condo.mlr1)-----------------------------------------------

Test Statistic pvalue

-----------------------------------------------

Shapiro-Wilk 0.6856 0.0000

Kolmogorov-Smirnov 0.1366 0.0000

Cramer-von Mises 121.0768 0.0000

Anderson-Darling 67.9551 0.0000

-----------------------------------------------The summary table above reveals that the p-values of the four tests are way smaller than the alpha value of 0.05. Hence we will reject the null hypothesis and infer that there is statistical evidence that the residuals are not normally distributed.

6.8.5.4 Testing for Spatial Autocorrelation

The hedonic model we try to build uses geographically referenced attributes, hence it is also important for us to visualise the residual of the hedonic pricing model.

In order to perform spatial autocorrelation test, we need to convert condo_resale.sf from sf data frame into a SpatialPointsDataFrame.

First, we will export the residual of the hedonic pricing model and save it as a data frame.

mlr.output <- as.data.frame(condo.mlr1$residuals)Next, we will join the newly created data frame with condo_resale.sf object.

condo_resale.res.sf <- cbind(condo_resale.sf,

condo.mlr1$residuals) %>%

rename(`MLR_RES` = `condo.mlr1.residuals`)Next, we convert condo_resale.res.sf from simple feature object into a SpatialPointsDataFrame because spdep package can only process sp conformed spatial data objects.

The code chunk below will be used to perform the data conversion process.

condo_resale.sp <- as_Spatial(condo_resale.res.sf)

condo_resale.spclass : SpatialPointsDataFrame

features : 1436

extent : 14940.85, 43352.45, 24765.67, 48382.81 (xmin, xmax, ymin, ymax)

crs : +proj=tmerc +lat_0=1.36666666666667 +lon_0=103.833333333333 +k=1 +x_0=28001.642 +y_0=38744.572 +ellps=WGS84 +towgs84=0,0,0,0,0,0,0 +units=m +no_defs

variables : 23

names : POSTCODE, SELLING_PRICE, AREA_SQM, AGE, PROX_CBD, PROX_CHILDCARE, PROX_ELDERLYCARE, PROX_URA_GROWTH_AREA, PROX_HAWKER_MARKET, PROX_KINDERGARTEN, PROX_MRT, PROX_PARK, PROX_PRIMARY_SCH, PROX_TOP_PRIMARY_SCH, PROX_SHOPPING_MALL, ...

min values : 18965, 540000, 34, 0, 0.386916393, 0.004927023, 0.054508623, 0.214539508, 0.051817113, 0.004927023, 0.052779424, 0.029064164, 0.077106132, 0.077106132, 0, ...

max values : 828833, 18000000, 619, 37, 19.18042832, 3.46572633, 3.949157205, 9.15540001, 5.374348075, 2.229045366, 3.48037319, 2.16104919, 3.928989144, 6.748192062, 3.477433767, ... Next, we use tmap package to display the distribution of the residuals on an interactive map.

The code churn below will turn on the interactive mode of tmap.

tmap_mode("view")The code chunks below is used to create an interactive point symbol map.

tm_shape(mpsz_svy21)+

tmap_options(check.and.fix = TRUE) +

tm_polygons(alpha = 0.4) +

tm_shape(condo_resale.res.sf) +

tm_dots(col = "MLR_RES",

alpha = 0.6,

style="quantile") +

tm_view(set.zoom.limits = c(11,14))We switch back to “plot” mode before we continue.

tmap_mode("plot")The figure above reveal that there is sign of spatial autocorrelation.

To prove that our observation is indeed true, the Moran’s I test will be performed

First, we will compute the distance-based weight matrix by using dnearneigh() function of spdep.

nb <- dnearneigh(coordinates(condo_resale.sp), 0, 1500, longlat = FALSE)

summary(nb)Neighbour list object:

Number of regions: 1436

Number of nonzero links: 66266

Percentage nonzero weights: 3.213526

Average number of links: 46.14624

Link number distribution:

1 3 5 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

3 3 9 4 3 15 10 19 17 45 19 5 14 29 19 6 35 45 18 47

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44

16 43 22 26 21 11 9 23 22 13 16 25 21 37 16 18 8 21 4 12

45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

8 36 18 14 14 43 11 12 8 13 12 13 4 5 6 12 11 20 29 33

65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84

15 20 10 14 15 15 11 16 12 10 8 19 12 14 9 8 4 13 11 6

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104

4 9 4 4 4 6 2 16 9 4 5 9 3 9 4 2 1 2 1 1

105 106 107 108 109 110 112 116 125

1 5 9 2 1 3 1 1 1

3 least connected regions:

193 194 277 with 1 link

1 most connected region:

285 with 125 linksNext, nb2listw() of spdep packge will be used to convert the output neighbours lists (i.e. nb) into a spatial weights.

nb_lw <- nb2listw(nb, style = 'W')

summary(nb_lw)Characteristics of weights list object:

Neighbour list object:

Number of regions: 1436

Number of nonzero links: 66266

Percentage nonzero weights: 3.213526

Average number of links: 46.14624

Link number distribution:

1 3 5 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

3 3 9 4 3 15 10 19 17 45 19 5 14 29 19 6 35 45 18 47

25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44

16 43 22 26 21 11 9 23 22 13 16 25 21 37 16 18 8 21 4 12

45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

8 36 18 14 14 43 11 12 8 13 12 13 4 5 6 12 11 20 29 33

65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84

15 20 10 14 15 15 11 16 12 10 8 19 12 14 9 8 4 13 11 6

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104

4 9 4 4 4 6 2 16 9 4 5 9 3 9 4 2 1 2 1 1

105 106 107 108 109 110 112 116 125

1 5 9 2 1 3 1 1 1

3 least connected regions:

193 194 277 with 1 link

1 most connected region:

285 with 125 links

Weights style: W

Weights constants summary:

n nn S0 S1 S2

W 1436 2062096 1436 94.81916 5798.341We use lm.morantest() of spdep package to perform Moran’s I test for residual spatial autocorrelation.

lm.morantest(condo.mlr1, nb_lw)

Global Moran I for regression residuals

data:

model: lm(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA + PROX_MRT +

PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD, data = condo_resale.sf)

weights: nb_lw

Moran I statistic standard deviate = 24.366, p-value <

0.00000000000000022

alternative hypothesis: greater

sample estimates:

Observed Moran I Expectation Variance

0.14388758039 -0.00548759352 0.00003758259 The Global Moran’s I test for residual spatial autocorrelation shows that it’s p-value is less than 0.00000000000000022 which is less than the alpha value of 0.05. Hence, we reject the null hypothesis that the residuals are randomly distributed.

Since the observed Global Moran I = 0.1424418 which is greater than 0, we can infer than the residuals resemble cluster distribution.

6.9 Building Hedonic Pricing Models using GWmodel

In this section, we learn how to model hedonic pricing using both the fixed and adaptive bandwidth schemes

6.9.1 Build Fixed Bandwidth GWR Model

6.9.1.1 Compute fixed bandwith

In the code chunk below bw.gwr() of GWModel package is used to determine the optimal fixed bandwidth to use in the model.

Notice that the adaptive argument of the function is set to FALSE to indicate that we are interested to compute the fixed bandwidth.

There are two possible approaches to determine the stopping rule using the approach argument, they are:

CV cross-validation approach and

AIC corrected (AICc) approach.

bw.fixed <- bw.gwr(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_SHOPPING_MALL + PROX_BUS_STOP + NO_Of_UNITS +

FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sp,

approach="CV",

kernel="gaussian",

adaptive=FALSE,

longlat=FALSE)Fixed bandwidth: 17660.96 CV score: 825911822102784

Fixed bandwidth: 10917.26 CV score: 797045428603044

Fixed bandwidth: 6749.419 CV score: 727327288217123

Fixed bandwidth: 4173.553 CV score: 630000557301613

Fixed bandwidth: 2581.58 CV score: 540495781061281

Fixed bandwidth: 1597.687 CV score: 485751468826412

Fixed bandwidth: 989.6077 CV score: 472243119301430

Fixed bandwidth: 613.7939 CV score: 13782937640587258

Fixed bandwidth: 1221.873 CV score: 477871653167391

Fixed bandwidth: 846.0596 CV score: 479162862134549

Fixed bandwidth: 1078.325 CV score: 475140559147296

Fixed bandwidth: 934.7772 CV score: 472517998221988

Fixed bandwidth: 1023.495 CV score: 473030451602862

Fixed bandwidth: 968.6643 CV score: 472131662464349

Fixed bandwidth: 955.7206 CV score: 472207171142149

Fixed bandwidth: 976.6639 CV score: 472138689617517

Fixed bandwidth: 963.7202 CV score: 472148360843733

Fixed bandwidth: 971.7199 CV score: 472129280399246

Fixed bandwidth: 973.6083 CV score: 472130919502945

Fixed bandwidth: 970.5527 CV score: 472129460396064

Fixed bandwidth: 972.4412 CV score: 472129623282981

Fixed bandwidth: 971.2741 CV score: 472129241640866

Fixed bandwidth: 970.9985 CV score: 472129284813527

Fixed bandwidth: 971.4443 CV score: 472129240228113

Fixed bandwidth: 971.5496 CV score: 472129250323808

Fixed bandwidth: 971.3793 CV score: 472129239194007

Fixed bandwidth: 971.3391 CV score: 472129239110127

Fixed bandwidth: 971.3143 CV score: 472129239714645

Fixed bandwidth: 971.3545 CV score: 472129239206061

Fixed bandwidth: 971.3296 CV score: 472129239931915

Fixed bandwidth: 971.345 CV score: 472129239140163

Fixed bandwidth: 971.3355 CV score: 472129239682463

Fixed bandwidth: 971.3413 CV score: 472129239743000

Fixed bandwidth: 971.3377 CV score: 472129239211951

Fixed bandwidth: 971.34 CV score: 472129238819453

Fixed bandwidth: 971.3405 CV score: 472129238593600

Fixed bandwidth: 971.3408 CV score: 472129238647549

Fixed bandwidth: 971.3403 CV score: 472129239624159

Fixed bandwidth: 971.3406 CV score: 472129239431032

Fixed bandwidth: 971.3404 CV score: 472129239241864

Fixed bandwidth: 971.3405 CV score: 472129239130278

Fixed bandwidth: 971.3405 CV score: 472129238832217 The result shows that the recommended bandwidth is 971.3398 metres.

| Quiz: |

|---|

Do you know why it is in metres? Reply: The Projected CRS of SVY21 and transformed equivalent under EPSG:3414 for the URA Master Plan 2014’s planning subzone boundarie sare measured in metres. |

6.9.1.2 GWModel method - fixed bandwith

Now we can use the code chunk below to calibrate the GWR model using fixed bandwidth and gaussian kernel.

gwr.fixed <- gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH +

PROX_SHOPPING_MALL + PROX_BUS_STOP + NO_Of_UNITS +

FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sp,

bw=bw.fixed,

kernel = 'gaussian',

longlat = FALSE)The output is saved in a list of class “gwrm”. The code below is used to display the model output.

gwr.fixed ***********************************************************************

* Package GWmodel *

***********************************************************************

Program starts at: 2022-12-17 23:50:58

Call:

gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp, bw = bw.fixed, kernel = "gaussian",

longlat = FALSE)

Dependent (y) variable: SELLING_PRICE

Independent variables: AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

Number of data points: 1436

***********************************************************************

* Results of Global Regression *

***********************************************************************

Call:

lm(formula = formula, data = data)

Residuals:

Min 1Q Median 3Q Max

-3470778 -298119 -23481 248917 12234210

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 527633.22 108183.22 4.877 0.000001196976743 ***

AREA_SQM 12777.52 367.48 34.771 < 0.0000000000000002 ***

AGE -24687.74 2754.84 -8.962 < 0.0000000000000002 ***

PROX_CBD -77131.32 5763.12 -13.384 < 0.0000000000000002 ***

PROX_CHILDCARE -318472.75 107959.51 -2.950 0.003231 **

PROX_ELDERLYCARE 185575.62 39901.86 4.651 0.000003613932545 ***

PROX_URA_GROWTH_AREA 39163.25 11754.83 3.332 0.000885 ***

PROX_MRT -294745.11 56916.37 -5.179 0.000000255705220 ***

PROX_PARK 570504.81 65507.03 8.709 < 0.0000000000000002 ***

PROX_PRIMARY_SCH 159856.14 60234.60 2.654 0.008046 **

PROX_SHOPPING_MALL -220947.25 36561.83 -6.043 0.000000001927962 ***

PROX_BUS_STOP 682482.22 134513.24 5.074 0.000000441637621 ***

NO_Of_UNITS -245.48 87.95 -2.791 0.005321 **

FAMILY_FRIENDLY 146307.58 46893.02 3.120 0.001845 **

FREEHOLD 350599.81 48506.48 7.228 0.000000000000798 ***

---Significance stars

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 756000 on 1421 degrees of freedom

Multiple R-squared: 0.6507

Adjusted R-squared: 0.6472

F-statistic: 189.1 on 14 and 1421 DF, p-value: < 0.00000000000000022

***Extra Diagnostic information

Residual sum of squares: 812060890958409

Sigma(hat): 752522.9

AIC: 42966.76

AICc: 42967.14

BIC: 41731.39

***********************************************************************

* Results of Geographically Weighted Regression *

***********************************************************************

*********************Model calibration information*********************

Kernel function: gaussian

Fixed bandwidth: 971.3405

Regression points: the same locations as observations are used.

Distance metric: Euclidean distance metric is used.

****************Summary of GWR coefficient estimates:******************

Min. 1st Qu. Median 3rd Qu.

Intercept -35988365.488 -519979.772 767797.337 1741234.306

AREA_SQM 1000.279 5275.779 7474.018 12300.971

AGE -134749.495 -20813.274 -8626.003 -3778.370

PROX_CBD -77047270.137 -236081.916 -83599.576 34645.575

PROX_CHILDCARE -6009730.044 -336665.767 -97425.465 290074.489

PROX_ELDERLYCARE -3500042.494 -159702.666 31970.528 195774.638

PROX_URA_GROWTH_AREA -3016996.080 -82013.243 70749.084 226119.338

PROX_MRT -3528172.076 -658357.468 -188328.987 36922.070

PROX_PARK -1206240.925 -217315.894 35383.116 413347.109

PROX_PRIMARY_SCH -22695027.094 -170660.239 48471.907 515551.477

PROX_SHOPPING_MALL -7258466.404 -166844.608 -10516.913 159227.798

PROX_BUS_STOP -1467612.709 -45206.664 376007.005 1166445.776

NO_Of_UNITS -1317.036 -248.223 -30.846 254.959

FAMILY_FRIENDLY -2274938.102 -111395.125 7621.363 161067.297

FREEHOLD -9206722.091 38073.481 151694.047 375277.911

Max.

Intercept 112793548

AREA_SQM 21575

AGE 434201

PROX_CBD 2704596

PROX_CHILDCARE 1654087

PROX_ELDERLYCARE 38867814

PROX_URA_GROWTH_AREA 78515730

PROX_MRT 3124316

PROX_PARK 18122425

PROX_PRIMARY_SCH 4637503

PROX_SHOPPING_MALL 1529952

PROX_BUS_STOP 11342182

NO_Of_UNITS 12907

FAMILY_FRIENDLY 1720744

FREEHOLD 6073636

************************Diagnostic information*************************

Number of data points: 1436

Effective number of parameters (2trace(S) - trace(S'S)): 438.3804

Effective degrees of freedom (n-2trace(S) + trace(S'S)): 997.6196

AICc (GWR book, Fotheringham, et al. 2002, p. 61, eq 2.33): 42263.61

AIC (GWR book, Fotheringham, et al. 2002,GWR p. 96, eq. 4.22): 41632.36

BIC (GWR book, Fotheringham, et al. 2002,GWR p. 61, eq. 2.34): 42515.71

Residual sum of squares: 253407016000767

R-square value: 0.8909912

Adjusted R-square value: 0.8430417

***********************************************************************

Program stops at: 2022-12-17 23:50:59 The report shows that the Adjusted R-square of the gwr is 0.8430 which is significantly better than the global multiple linear regression model of 0.6472.

6.9.2 Build Adaptive Bandwidth GWR Model

In this section, we calibrate the gwr-absed hedonic pricing model by using the adaptive bandwidth approach.

6.9.2.1 Compute the adaptive bandwidth

Similar to the earlier section, we first use bw.ger() to determine the recommended data point to use.

The code chunk used look very similar to the one used to compute the fixed bandwidth except the adaptive argument has changed to TRUE.

bw.adaptive <- bw.gwr(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sp,

approach="CV",

kernel="gaussian",

adaptive=TRUE,

longlat=FALSE)Adaptive bandwidth: 895 CV score: 795240067952916

Adaptive bandwidth: 561 CV score: 766736415369131

Adaptive bandwidth: 354 CV score: 695345377846985

Adaptive bandwidth: 226 CV score: 615223032444228

Adaptive bandwidth: 147 CV score: 567437338972766

Adaptive bandwidth: 98 CV score: 542674453374480

Adaptive bandwidth: 68 CV score: 516811696101366

Adaptive bandwidth: 49 CV score: 485963124854345

Adaptive bandwidth: 37 CV score: 464651804391025

Adaptive bandwidth: 30 CV score: 442208792500332

Adaptive bandwidth: 25 CV score: 443081571798103

Adaptive bandwidth: 32 CV score: 450560182354864

Adaptive bandwidth: 27 CV score: 446217190611572

Adaptive bandwidth: 30 CV score: 442208792500332 The result shows that the 30 is the recommended data points to be used.

6.9.2.2 Constructing the adaptive bandwidth gwr model

Now, we can go ahead to calibrate the gwr-based hedonic pricing model by using adaptive bandwidth and gaussian kernel as shown in the code chunk below.

gwr.adaptive <- gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE +

PROX_CBD + PROX_CHILDCARE + PROX_ELDERLYCARE +

PROX_URA_GROWTH_AREA + PROX_MRT + PROX_PARK +

PROX_PRIMARY_SCH + PROX_SHOPPING_MALL + PROX_BUS_STOP +

NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data=condo_resale.sp, bw=bw.adaptive,

kernel = 'gaussian',

adaptive=TRUE,

longlat = FALSE)The code below can be used to display the model output.

gwr.adaptive ***********************************************************************

* Package GWmodel *

***********************************************************************

Program starts at: 2022-12-17 23:51:04

Call:

gwr.basic(formula = SELLING_PRICE ~ AREA_SQM + AGE + PROX_CBD +

PROX_CHILDCARE + PROX_ELDERLYCARE + PROX_URA_GROWTH_AREA +

PROX_MRT + PROX_PARK + PROX_PRIMARY_SCH + PROX_SHOPPING_MALL +

PROX_BUS_STOP + NO_Of_UNITS + FAMILY_FRIENDLY + FREEHOLD,

data = condo_resale.sp, bw = bw.adaptive, kernel = "gaussian",

adaptive = TRUE, longlat = FALSE)

Dependent (y) variable: SELLING_PRICE

Independent variables: AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

Number of data points: 1436

***********************************************************************

* Results of Global Regression *

***********************************************************************

Call:

lm(formula = formula, data = data)

Residuals:

Min 1Q Median 3Q Max

-3470778 -298119 -23481 248917 12234210

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 527633.22 108183.22 4.877 0.000001196976743 ***

AREA_SQM 12777.52 367.48 34.771 < 0.0000000000000002 ***

AGE -24687.74 2754.84 -8.962 < 0.0000000000000002 ***

PROX_CBD -77131.32 5763.12 -13.384 < 0.0000000000000002 ***

PROX_CHILDCARE -318472.75 107959.51 -2.950 0.003231 **

PROX_ELDERLYCARE 185575.62 39901.86 4.651 0.000003613932545 ***

PROX_URA_GROWTH_AREA 39163.25 11754.83 3.332 0.000885 ***

PROX_MRT -294745.11 56916.37 -5.179 0.000000255705220 ***

PROX_PARK 570504.81 65507.03 8.709 < 0.0000000000000002 ***

PROX_PRIMARY_SCH 159856.14 60234.60 2.654 0.008046 **

PROX_SHOPPING_MALL -220947.25 36561.83 -6.043 0.000000001927962 ***

PROX_BUS_STOP 682482.22 134513.24 5.074 0.000000441637621 ***

NO_Of_UNITS -245.48 87.95 -2.791 0.005321 **

FAMILY_FRIENDLY 146307.58 46893.02 3.120 0.001845 **

FREEHOLD 350599.81 48506.48 7.228 0.000000000000798 ***

---Significance stars

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 756000 on 1421 degrees of freedom

Multiple R-squared: 0.6507

Adjusted R-squared: 0.6472

F-statistic: 189.1 on 14 and 1421 DF, p-value: < 0.00000000000000022

***Extra Diagnostic information

Residual sum of squares: 812060890958409

Sigma(hat): 752522.9

AIC: 42966.76

AICc: 42967.14

BIC: 41731.39

***********************************************************************

* Results of Geographically Weighted Regression *

***********************************************************************

*********************Model calibration information*********************

Kernel function: gaussian

Adaptive bandwidth: 30 (number of nearest neighbours)

Regression points: the same locations as observations are used.

Distance metric: Euclidean distance metric is used.

****************Summary of GWR coefficient estimates:******************

Min. 1st Qu. Median

Intercept -134874192.014 -246693.174 779280.345

AREA_SQM 3318.817 5628.499 7782.486

AGE -96746.436 -29287.820 -14042.717

PROX_CBD -2533033.423 -162556.006 -77241.667

PROX_CHILDCARE -1279036.792 -201752.740 8715.804

PROX_ELDERLYCARE -1621217.923 -92049.948 61029.215

PROX_URA_GROWTH_AREA -7268553.018 -30350.048 45868.678

PROX_MRT -43780537.042 -672818.354 -221150.271

PROX_PARK -2902027.105 -167820.665 116014.299

PROX_PRIMARY_SCH -864176.067 -166266.939 -7785.325

PROX_SHOPPING_MALL -1827150.999 -131754.889 -14049.330

PROX_BUS_STOP -2057895.720 -71460.777 411041.226

NO_Of_UNITS -2199.274 -236.853 -34.699

FAMILY_FRIENDLY -598786.697 -50926.596 26172.549

FREEHOLD -163402.522 40765.437 190227.133

3rd Qu. Max.

Intercept 1619360.306 18758355

AREA_SQM 12737.761 23064

AGE -5611.856 13303

PROX_CBD 2662.370 11346650

PROX_CHILDCARE 377776.875 2892127

PROX_ELDERLYCARE 281843.735 2465671

PROX_URA_GROWTH_AREA 246125.428 7384059

PROX_MRT -74593.417 1186242

PROX_PARK 465717.595 2588497

PROX_PRIMARY_SCH 432218.459 3381462

PROX_SHOPPING_MALL 137986.314 38038564

PROX_BUS_STOP 1207119.672 12081592

NO_Of_UNITS 116.573 1010

FAMILY_FRIENDLY 224806.072 2072414

FREEHOLD 379604.132 1813995

************************Diagnostic information*************************

Number of data points: 1436

Effective number of parameters (2trace(S) - trace(S'S)): 350.3088

Effective degrees of freedom (n-2trace(S) + trace(S'S)): 1085.691

AICc (GWR book, Fotheringham, et al. 2002, p. 61, eq 2.33): 41982.22

AIC (GWR book, Fotheringham, et al. 2002,GWR p. 96, eq. 4.22): 41546.74

BIC (GWR book, Fotheringham, et al. 2002,GWR p. 61, eq. 2.34): 41914.08

Residual sum of squares: 252822722477010

R-square value: 0.8912425

Adjusted R-square value: 0.8561185

***********************************************************************

Program stops at: 2022-12-17 23:51:05 The report shows that the Adjusted R-square of the gwr is 0.8561 which, again, is significantly better than the global multiple linear regression model of 0.6472.

6.9.3 Decoding the GWR Outputs

In addition to regression residuals, the output feature class table includes fields for observed and predicted y values, condition number (cond), Local R2, residuals, explanatory variable coefficients and standard errors:

Condition Number: this diagnostic evaluates local collinearity. In the presence of strong local collinearity, results become unstable. Results associated with condition numbers larger than 30, may be unreliable.

Local R2: these values range between 0.0 and 1.0 and indicate how well the local regression model fits observed y values. Very low values indicate the local model is performing poorly. Mapping the Local R2 values to see where GWR predicts well and where it predicts poorly may provide clues about important variables that may be missing in the regression model.

Predicted: these are the estimated (or fitted) y values computed by the GWR.

Residuals: to obtain the residual values, the fitted y values are subtracted from the observed y values. Standardized residuals have a mean of 0 and a standard deviation of 1. A cold-to-hot rendered map of standardized residuals can be produced by using these values.

Coefficient Standard Error: these values measure the reliability of each coefficient estimate. Confidence in those estimates are higher when standard errors are small in relation to the actual coefficient values. Large standard errors may indicate problems with local collinearity.

They are all stored in a SpatialPointsDataFrame or SpatialPolygonsDataFrame object integrated with fit.points, GWR coefficient estimates, y value, predicted values, coefficient standard errors and t-values in its “data” slot in an object called SDF of the output list.

6.9.4 Convert SDF into sf data.frame

To visualise the fields in SDF, we need to first covert it into sf data.frame by using the code chunk below.

condo_resale.sf.adaptive <- st_as_sf(gwr.adaptive$SDF) %>%

st_transform(crs=3414)condo_resale.sf.adaptive.svy21 <- st_transform(condo_resale.sf.adaptive, 3414)

condo_resale.sf.adaptive.svy21 Simple feature collection with 1436 features and 51 fields

Geometry type: POINT

Dimension: XY

Bounding box: xmin: 14940.85 ymin: 24765.67 xmax: 43352.45 ymax: 48382.81

Projected CRS: SVY21 / Singapore TM

First 10 features:

Intercept AREA_SQM AGE PROX_CBD PROX_CHILDCARE PROX_ELDERLYCARE

1 2050011.7 9561.892 -9514.634 -120681.9 319266.92 -393417.79

2 1633128.2 16576.853 -58185.479 -149434.2 441102.18 325188.74

3 3433608.2 13091.861 -26707.386 -259397.8 -120116.82 535855.81

4 234358.9 20730.601 -93308.988 2426853.7 480825.28 314783.72

5 2285804.9 6722.836 -17608.018 -316835.5 90764.78 -137384.61

6 -3568877.4 6039.581 -26535.592 327306.1 -152531.19 -700392.85

7 -2874842.4 16843.575 -59166.727 -983577.2 -177810.50 -122384.02

8 2038086.0 6905.135 -17681.897 -285076.6 70259.40 -96012.78

9 1718478.4 9580.703 -14401.128 105803.4 -657698.02 -123276.00

10 3457054.0 14072.011 -31579.884 -234895.4 79961.45 548581.04

PROX_URA_GROWTH_AREA PROX_MRT PROX_PARK PROX_PRIMARY_SCH

1 -159980.20 -299742.96 -172104.47 242668.03

2 -142290.39 -2510522.23 523379.72 1106830.66

3 -253621.21 -936853.28 209099.85 571462.33

4 -2679297.89 -2039479.50 -759153.26 3127477.21

5 303714.81 -44567.05 -10284.62 30413.56

6 -28051.25 733566.47 1511488.92 320878.23

7 1397676.38 -2745430.34 710114.74 1786570.95

8 269368.71 -14552.99 73533.34 53359.73

9 -361974.72 -476785.32 -132067.59 -40128.92

10 -150024.38 -1503835.53 574155.47 108996.67

PROX_SHOPPING_MALL PROX_BUS_STOP NO_Of_UNITS FAMILY_FRIENDLY FREEHOLD

1 300881.390 1210615.4 104.8290640 -9075.370 303955.6

2 -87693.378 1843587.2 -288.3441183 310074.664 396221.3

3 -126732.712 1411924.9 -9.5532945 5949.746 168821.7

4 -29593.342 7225577.5 -161.3551620 1556178.531 1212515.6

5 -7490.586 677577.0 42.2659674 58986.951 328175.2

6 258583.881 1086012.6 -214.3671271 201992.641 471873.1

7 -384251.210 5094060.5 -0.9212521 359659.512 408871.9

8 -39634.902 735767.1 30.1741069 55602.506 347075.0

9 276718.757 2815772.4 675.1615559 -30453.297 503872.8

10 -454726.822 2123557.0 -21.3044311 -100935.586 213324.6

y yhat residual CV_Score Stud_residual Intercept_SE AREA_SQM_SE

1 3000000 2886532 113468.16 0 0.38207013 516105.5 823.2860

2 3880000 3466801 413198.52 0 1.01433140 488083.5 825.2380

3 3325000 3616527 -291527.20 0 -0.83780678 963711.4 988.2240

4 4250000 5435482 -1185481.63 0 -2.84614670 444185.5 617.4007

5 1400000 1388166 11834.26 0 0.03404453 2119620.6 1376.2778

6 1320000 1516702 -196701.94 0 -0.72065800 28572883.7 2348.0091

7 3410000 3266881 143118.77 0 0.41291992 679546.6 893.5893

8 1420000 1431955 -11955.27 0 -0.03033109 2217773.1 1415.2604

9 2025000 1832799 192200.83 0 0.52018109 814281.8 943.8434

10 2550000 2223364 326635.53 0 1.10559735 2410252.0 1271.4073

AGE_SE PROX_CBD_SE PROX_CHILDCARE_SE PROX_ELDERLYCARE_SE

1 5889.782 37411.22 319111.1 120633.34

2 6226.916 23615.06 299705.3 84546.69

3 6510.236 56103.77 349128.5 129687.07

4 6010.511 469337.41 304965.2 127150.69

5 8180.361 410644.47 698720.6 327371.55

6 14601.909 5272846.47 1141599.8 1653002.19

7 8970.629 346164.20 530101.1 148598.71

8 8661.309 438035.69 742532.8 399221.05

9 11791.208 89148.35 704630.7 329683.30

10 9941.980 173532.77 500976.2 281876.74

PROX_URA_GROWTH_AREA_SE PROX_MRT_SE PROX_PARK_SE PROX_PRIMARY_SCH_SE

1 56207.39 185181.3 205499.6 152400.7

2 76956.50 281133.9 229358.7 165150.7

3 95774.60 275483.7 314124.3 196662.6

4 470762.12 279877.1 227249.4 240878.9

5 474339.56 363830.0 364580.9 249087.7

6 5496627.21 730453.2 1741712.0 683265.5

7 371692.97 375511.9 297400.9 344602.8

8 517977.91 423155.4 440984.4 261251.2

9 153436.22 285325.4 304998.4 278258.5

10 239182.57 571355.7 599131.8 331284.8

PROX_SHOPPING_MALL_SE PROX_BUS_STOP_SE NO_Of_UNITS_SE FAMILY_FRIENDLY_SE

1 109268.8 600668.6 218.1258 131474.7

2 98906.8 410222.1 208.9410 114989.1

3 119913.3 464156.7 210.9828 146607.2

4 177104.1 562810.8 361.7767 108726.6

5 301032.9 740922.4 299.5034 160663.7

6 2931208.6 1418333.3 602.5571 331727.0

7 249969.5 821236.4 532.1978 129241.2

8 351634.0 775038.4 338.6777 171895.1

9 289872.7 850095.5 439.9037 220223.4

10 265529.7 631399.2 259.0169 189125.5

FREEHOLD_SE Intercept_TV AREA_SQM_TV AGE_TV PROX_CBD_TV

1 115954.0 3.9720784 11.614302 -1.615447 -3.22582173

2 130110.0 3.3460017 20.087361 -9.344188 -6.32792021

3 141031.5 3.5629010 13.247868 -4.102368 -4.62353528

4 138239.1 0.5276150 33.577223 -15.524302 5.17080808

5 210641.1 1.0784029 4.884795 -2.152474 -0.77155660

6 374347.3 -0.1249043 2.572214 -1.817269 0.06207388

7 182216.9 -4.2305303 18.849348 -6.595605 -2.84136028

8 216649.4 0.9189786 4.879056 -2.041481 -0.65080678

9 220473.7 2.1104224 10.150733 -1.221345 1.18682383

10 206346.2 1.4343123 11.068059 -3.176418 -1.35360852

PROX_CHILDCARE_TV PROX_ELDERLYCARE_TV PROX_URA_GROWTH_AREA_TV PROX_MRT_TV

1 1.00048819 -3.2612693 -2.846248368 -1.61864578

2 1.47178634 3.8462625 -1.848971738 -8.92998600

3 -0.34404755 4.1319138 -2.648105057 -3.40075727

4 1.57665606 2.4756745 -5.691404992 -7.28705261

5 0.12990138 -0.4196596 0.640289855 -0.12249416

6 -0.13361179 -0.4237096 -0.005103357 1.00426206

7 -0.33542751 -0.8235874 3.760298131 -7.31116712

8 0.09462126 -0.2405003 0.520038994 -0.03439159

9 -0.93339393 -0.3739225 -2.359121712 -1.67102293

10 0.15961128 1.9461735 -0.627237944 -2.63204802

PROX_PARK_TV PROX_PRIMARY_SCH_TV PROX_SHOPPING_MALL_TV PROX_BUS_STOP_TV

1 -0.83749312 1.5923022 2.75358842 2.0154464

2 2.28192684 6.7019454 -0.88662640 4.4941192

3 0.66565951 2.9058009 -1.05686949 3.0419145

4 -3.34061770 12.9836105 -0.16709578 12.8383775

5 -0.02820944 0.1220998 -0.02488294 0.9145046

6 0.86781794 0.4696245 0.08821750 0.7656963

7 2.38773567 5.1844351 -1.53719231 6.2029165

8 0.16674816 0.2042469 -0.11271635 0.9493299

9 -0.43301073 -0.1442145 0.95462153 3.3123012

10 0.95831249 0.3290120 -1.71252687 3.3632555

NO_Of_UNITS_TV FAMILY_FRIENDLY_TV FREEHOLD_TV Local_R2

1 0.480589953 -0.06902748 2.621347 0.8846744

2 -1.380026395 2.69655779 3.045280 0.8899773

3 -0.045279967 0.04058290 1.197050 0.8947007

4 -0.446007570 14.31276425 8.771149 0.9073605

5 0.141120178 0.36714544 1.557983 0.9510057

6 -0.355762335 0.60891234 1.260522 0.9247586

7 -0.001731033 2.78285441 2.243875 0.8310458

8 0.089093858 0.32346758 1.602012 0.9463936

9 1.534793921 -0.13828365 2.285410 0.8380365

10 -0.082251138 -0.53369623 1.033819 0.9080753

geometry

1 POINT (22085.12 29951.54)

2 POINT (25656.84 34546.2)

3 POINT (23963.99 32890.8)

4 POINT (27044.28 32319.77)

5 POINT (41042.56 33743.64)

6 POINT (39717.04 32943.1)

7 POINT (28419.1 33513.37)

8 POINT (40763.57 33879.61)

9 POINT (23595.63 28884.78)

10 POINT (24586.56 33194.31)gwr.adaptive.output <- as.data.frame(gwr.adaptive$SDF)

condo_resale.sf.adaptive <- cbind(condo_resale.res.sf, as.matrix(gwr.adaptive.output))Next, we use glimpse() to display the content of condo_resale.sf.adaptive sf data frame.

glimpse(condo_resale.sf.adaptive)Rows: 1,436

Columns: 77

$ POSTCODE <dbl> 118635, 288420, 267833, 258380, 467169, 466472…

$ SELLING_PRICE <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1…

$ AREA_SQM <dbl> 309, 290, 248, 127, 145, 139, 218, 141, 165, 1…

$ AGE <dbl> 30, 32, 33, 7, 28, 22, 24, 24, 27, 31, 17, 22,…

$ PROX_CBD <dbl> 7.941259, 6.609797, 6.898000, 4.038861, 11.783…

$ PROX_CHILDCARE <dbl> 0.16597932, 0.28027246, 0.42922669, 0.39473543…

$ PROX_ELDERLYCARE <dbl> 2.5198118, 1.9333338, 0.5021395, 1.9910316, 1.…

$ PROX_URA_GROWTH_AREA <dbl> 6.618741, 7.505109, 6.463887, 4.906512, 6.4106…

$ PROX_HAWKER_MARKET <dbl> 1.76542207, 0.54507614, 0.37789301, 1.68259969…

$ PROX_KINDERGARTEN <dbl> 0.05835552, 0.61592412, 0.14120309, 0.38200076…

$ PROX_MRT <dbl> 0.5607188, 0.6584461, 0.3053433, 0.6910183, 0.…

$ PROX_PARK <dbl> 1.1710446, 0.1992269, 0.2779886, 0.9832843, 0.…

$ PROX_PRIMARY_SCH <dbl> 1.6340256, 0.9747834, 1.4715016, 1.4546324, 0.…

$ PROX_TOP_PRIMARY_SCH <dbl> 3.3273195, 0.9747834, 1.4715016, 2.3006394, 0.…

$ PROX_SHOPPING_MALL <dbl> 2.2102717, 2.9374279, 1.2256850, 0.3525671, 1.…

$ PROX_SUPERMARKET <dbl> 0.9103958, 0.5900617, 0.4135583, 0.4162219, 0.…

$ PROX_BUS_STOP <dbl> 0.10336166, 0.28673408, 0.28504777, 0.29872340…

$ NO_Of_UNITS <dbl> 18, 20, 27, 30, 30, 31, 32, 32, 32, 32, 34, 34…

$ FAMILY_FRIENDLY <dbl> 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 0, 0, 0, 0…

$ FREEHOLD <dbl> 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 1, 1…

$ LEASEHOLD_99YR <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ LOG_SELLING_PRICE <dbl> 14.91412, 15.17135, 15.01698, 15.26243, 14.151…

$ MLR_RES <dbl> -1489099.55, 415494.57, 194129.69, 1088992.71,…

$ Intercept <dbl> 2050011.67, 1633128.24, 3433608.17, 234358.91,…

$ AREA_SQM.1 <dbl> 9561.892, 16576.853, 13091.861, 20730.601, 672…

$ AGE.1 <dbl> -9514.634, -58185.479, -26707.386, -93308.988,…

$ PROX_CBD.1 <dbl> -120681.94, -149434.22, -259397.77, 2426853.66…

$ PROX_CHILDCARE.1 <dbl> 319266.925, 441102.177, -120116.816, 480825.28…

$ PROX_ELDERLYCARE.1 <dbl> -393417.795, 325188.741, 535855.806, 314783.72…

$ PROX_URA_GROWTH_AREA.1 <dbl> -159980.203, -142290.389, -253621.206, -267929…

$ PROX_MRT.1 <dbl> -299742.96, -2510522.23, -936853.28, -2039479.…

$ PROX_PARK.1 <dbl> -172104.47, 523379.72, 209099.85, -759153.26, …

$ PROX_PRIMARY_SCH.1 <dbl> 242668.03, 1106830.66, 571462.33, 3127477.21, …

$ PROX_SHOPPING_MALL.1 <dbl> 300881.390, -87693.378, -126732.712, -29593.34…

$ PROX_BUS_STOP.1 <dbl> 1210615.44, 1843587.22, 1411924.90, 7225577.51…

$ NO_Of_UNITS.1 <dbl> 104.8290640, -288.3441183, -9.5532945, -161.35…

$ FAMILY_FRIENDLY.1 <dbl> -9075.370, 310074.664, 5949.746, 1556178.531, …

$ FREEHOLD.1 <dbl> 303955.61, 396221.27, 168821.75, 1212515.58, 3…

$ y <dbl> 3000000, 3880000, 3325000, 4250000, 1400000, 1…

$ yhat <dbl> 2886531.8, 3466801.5, 3616527.2, 5435481.6, 13…

$ residual <dbl> 113468.16, 413198.52, -291527.20, -1185481.63,…

$ CV_Score <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ Stud_residual <dbl> 0.38207013, 1.01433140, -0.83780678, -2.846146…

$ Intercept_SE <dbl> 516105.5, 488083.5, 963711.4, 444185.5, 211962…

$ AREA_SQM_SE <dbl> 823.2860, 825.2380, 988.2240, 617.4007, 1376.2…

$ AGE_SE <dbl> 5889.782, 6226.916, 6510.236, 6010.511, 8180.3…

$ PROX_CBD_SE <dbl> 37411.22, 23615.06, 56103.77, 469337.41, 41064…

$ PROX_CHILDCARE_SE <dbl> 319111.1, 299705.3, 349128.5, 304965.2, 698720…

$ PROX_ELDERLYCARE_SE <dbl> 120633.34, 84546.69, 129687.07, 127150.69, 327…

$ PROX_URA_GROWTH_AREA_SE <dbl> 56207.39, 76956.50, 95774.60, 470762.12, 47433…

$ PROX_MRT_SE <dbl> 185181.3, 281133.9, 275483.7, 279877.1, 363830…

$ PROX_PARK_SE <dbl> 205499.6, 229358.7, 314124.3, 227249.4, 364580…

$ PROX_PRIMARY_SCH_SE <dbl> 152400.7, 165150.7, 196662.6, 240878.9, 249087…

$ PROX_SHOPPING_MALL_SE <dbl> 109268.8, 98906.8, 119913.3, 177104.1, 301032.…

$ PROX_BUS_STOP_SE <dbl> 600668.6, 410222.1, 464156.7, 562810.8, 740922…

$ NO_Of_UNITS_SE <dbl> 218.1258, 208.9410, 210.9828, 361.7767, 299.50…

$ FAMILY_FRIENDLY_SE <dbl> 131474.73, 114989.07, 146607.22, 108726.62, 16…

$ FREEHOLD_SE <dbl> 115954.0, 130110.0, 141031.5, 138239.1, 210641…

$ Intercept_TV <dbl> 3.9720784, 3.3460017, 3.5629010, 0.5276150, 1.…

$ AREA_SQM_TV <dbl> 11.614302, 20.087361, 13.247868, 33.577223, 4.…

$ AGE_TV <dbl> -1.6154474, -9.3441881, -4.1023685, -15.524301…

$ PROX_CBD_TV <dbl> -3.22582173, -6.32792021, -4.62353528, 5.17080…

$ PROX_CHILDCARE_TV <dbl> 1.000488185, 1.471786337, -0.344047555, 1.5766…

$ PROX_ELDERLYCARE_TV <dbl> -3.26126929, 3.84626245, 4.13191383, 2.4756745…

$ PROX_URA_GROWTH_AREA_TV <dbl> -2.846248368, -1.848971738, -2.648105057, -5.6…

$ PROX_MRT_TV <dbl> -1.61864578, -8.92998600, -3.40075727, -7.2870…

$ PROX_PARK_TV <dbl> -0.83749312, 2.28192684, 0.66565951, -3.340617…

$ PROX_PRIMARY_SCH_TV <dbl> 1.59230221, 6.70194543, 2.90580089, 12.9836104…

$ PROX_SHOPPING_MALL_TV <dbl> 2.753588422, -0.886626400, -1.056869486, -0.16…

$ PROX_BUS_STOP_TV <dbl> 2.0154464, 4.4941192, 3.0419145, 12.8383775, 0…

$ NO_Of_UNITS_TV <dbl> 0.480589953, -1.380026395, -0.045279967, -0.44…

$ FAMILY_FRIENDLY_TV <dbl> -0.06902748, 2.69655779, 0.04058290, 14.312764…

$ FREEHOLD_TV <dbl> 2.6213469, 3.0452799, 1.1970499, 8.7711485, 1.…

$ Local_R2 <dbl> 0.8846744, 0.8899773, 0.8947007, 0.9073605, 0.…

$ coords.x1 <dbl> 22085.12, 25656.84, 23963.99, 27044.28, 41042.…

$ coords.x2 <dbl> 29951.54, 34546.20, 32890.80, 32319.77, 33743.…

$ geometry <POINT [m]> POINT (22085.12 29951.54), POINT (25656.…The predicted Selling Price for the transaction is summarised as follow:

summary(gwr.adaptive$SDF$yhat) Min. 1st Qu. Median Mean 3rd Qu. Max.

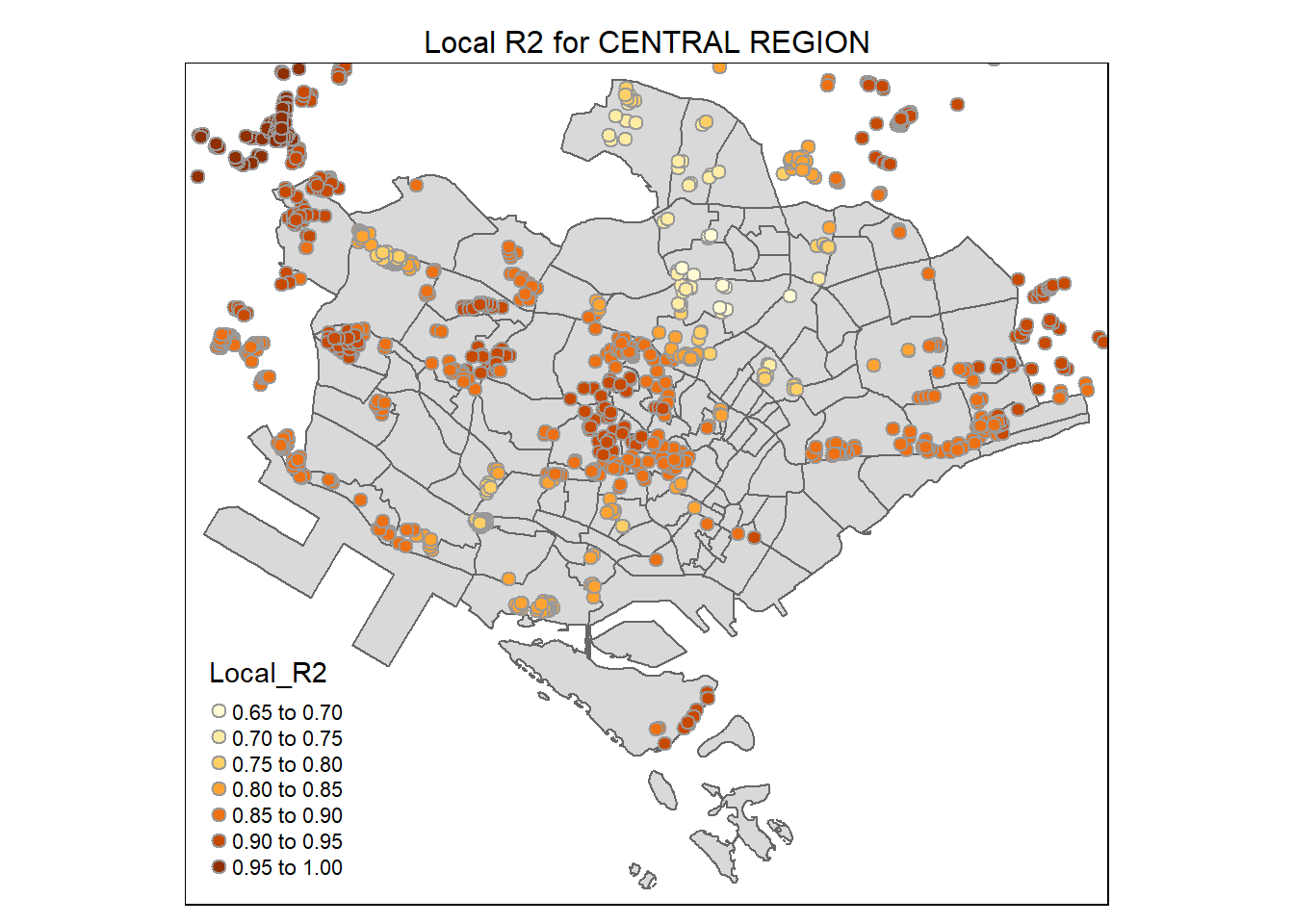

171347 1102001 1385528 1751842 1982307 13887901 6.9.5 Visualise Local R2

The code chunks below is used to create an interactive point symbol map.

tmap_mode("view")

tm_shape(mpsz_svy21)+

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "Local_R2",

border.col = "gray60",

border.lwd = 1) +

tm_view(set.zoom.limits = c(11,14))We then turn off interactive view.

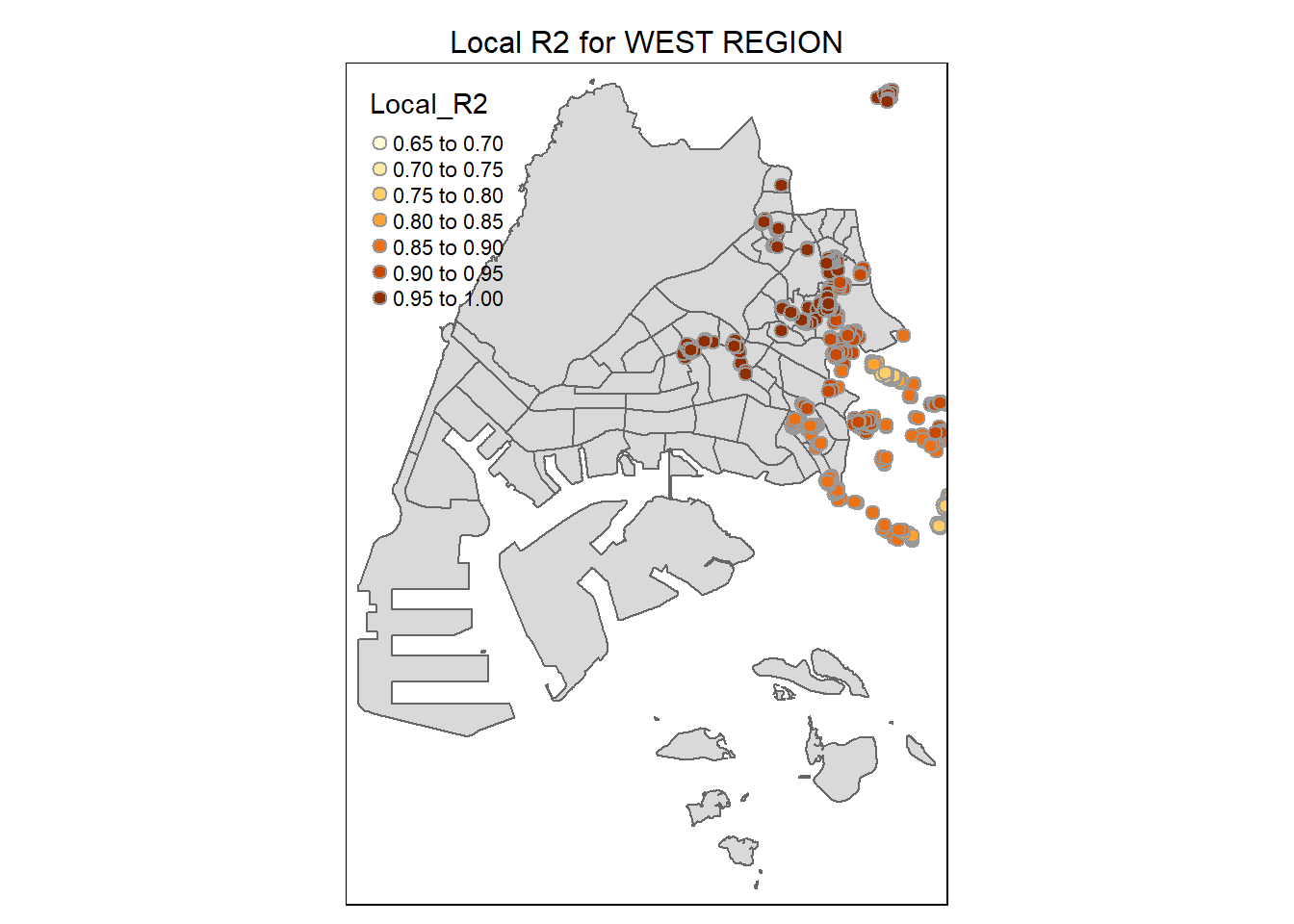

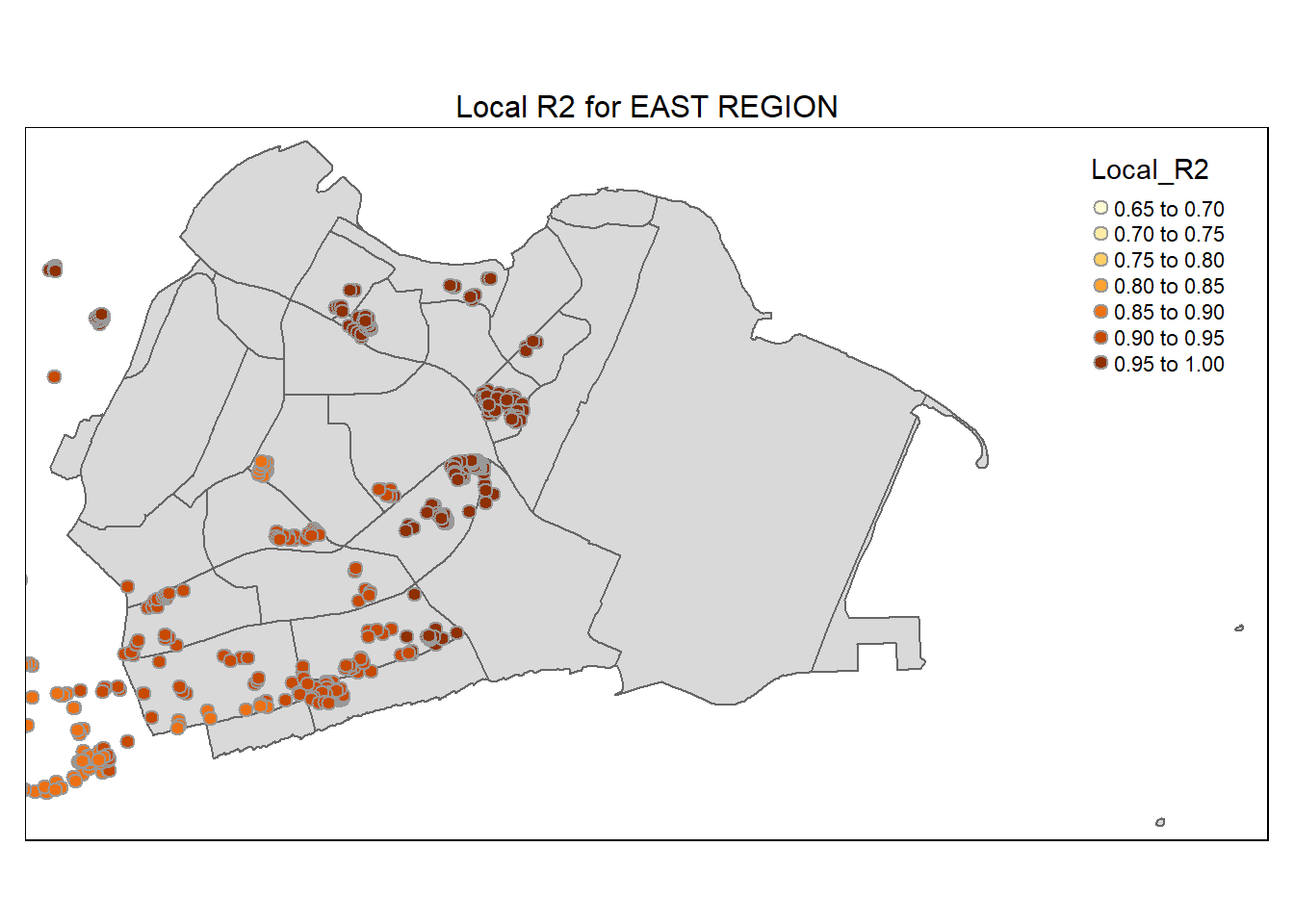

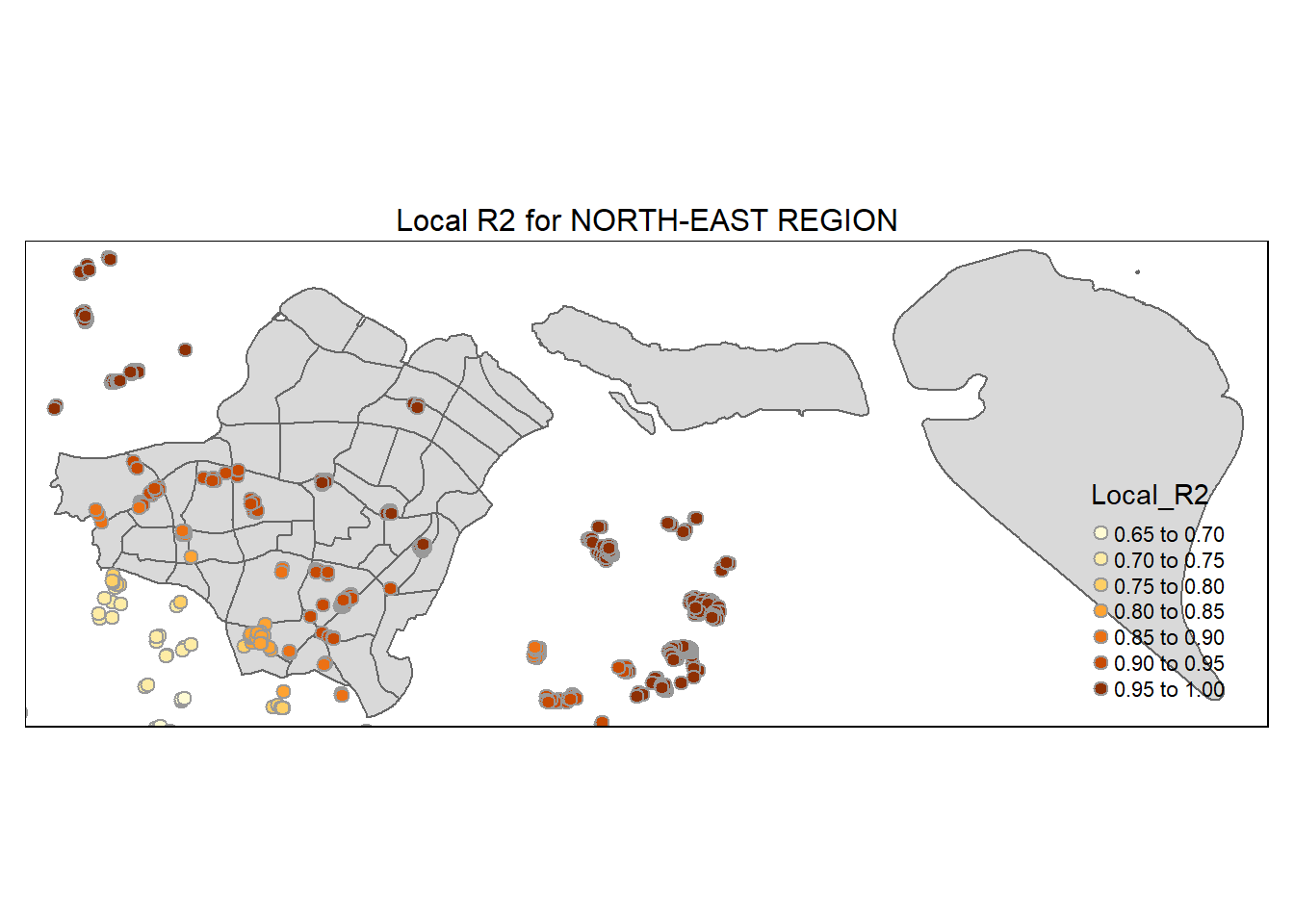

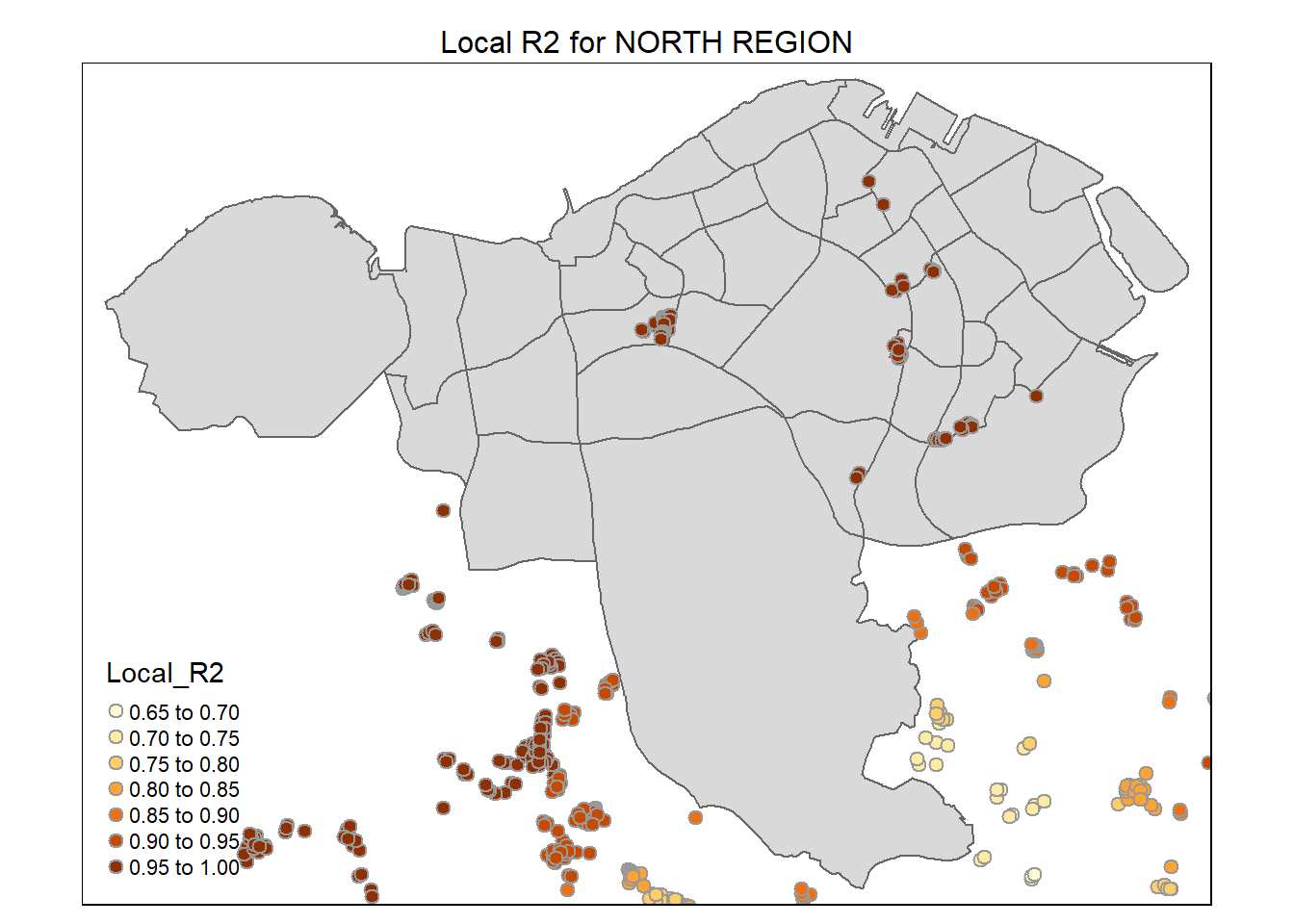

tmap_mode("plot")6.9.5.1 Visualise the Local R2 by URA Planning Region

We can print the maps with Local R2 values by Planning Region

planning_region <- c("CENTRAL REGION","WEST REGION","EAST REGION","NORTH-EAST REGION", "NORTH REGION")

for (region in planning_region){

print(tm_shape(mpsz_svy21[mpsz_svy21$REGION_N==region, ])+

tm_polygons()+

tm_shape(condo_resale.sf.adaptive) +

tm_bubbles(col = "Local_R2",

size = 0.15,

border.col = "gray60",

border.lwd = 1) +

tm_layout(main.title = paste("Local R2 for", region),

main.title.position = "center",

main.title.size = 1.0)

)

}

6.9.6 Visualise coefficient estimates

The code chunks below is used to create an interactive point symbol map.

# Switch to interactive plot

tmap_mode("view")

# Plot the coefficient estimates

AREA_SQM_SE <- tm_shape(mpsz_svy21)+

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "AREA_SQM_SE",

border.col = "gray60",

border.lwd = 1) +

tm_view(set.zoom.limits = c(11,14))

AREA_SQM_TV <- tm_shape(mpsz_svy21)+

tm_polygons(alpha = 0.1) +

tm_shape(condo_resale.sf.adaptive) +

tm_dots(col = "AREA_SQM_TV",

border.col = "gray60",

border.lwd = 1) +

tm_view(set.zoom.limits = c(11,14))

tmap_arrange(AREA_SQM_SE, AREA_SQM_TV,

asp=1, ncol=1, nrow = 2,

sync = TRUE)Switch back to view mode

tmap_mode("plot")6.10 Reference

Gollini I, Lu B, Charlton M, Brunsdon C, Harris P (2015) “GWmodel: an R Package for exploring Spatial Heterogeneity using Geographically Weighted Models”. Journal of Statistical Software, 63(17):1-50, http://www.jstatsoft.org/v63/i17/

Lu B, Harris P, Charlton M, Brunsdon C (2014) “The GWmodel R Package: further topics for exploring Spatial Heterogeneity using GeographicallyWeighted Models”. Geo-spatial Information Science 17(2): 85-101, http://www.tandfonline.com/doi/abs/10.1080/1009502.2014.917453

Dr. Kam TIn Seong (2022) , “ISSS602 Data Analytics Lab Lesson 5: The Granddaddy of All Models: Regression Analysis” Version 2.14.0